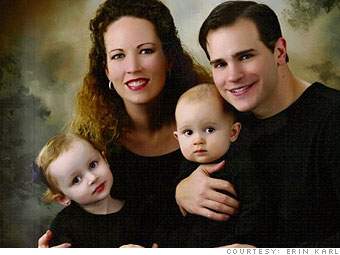

When Erin Karl and her husband, Rob, faced their debt, they were in the hole by about $115,000. That was in August 2009.

"It was about a month or two after we started paying down debt that interest rates started getting upped," Karl says. "If we hadn't started paying down our debt, we would have been in a mess because we were relying on our credit cards to make ends meet."

Since then, the couple has paid down nearly $50,000, sold their car and paid cash for a new-to-them minivan on Craig's List. For next year, they want to slice off another $30,000.

"We're not putting anything else into retirement savings or college," says Karl. "Everything is going to getting the credit card debt paid off."

To reach their goals, the Karls are working Dave Ramsey's plan for getting debt free, plus using DebtGoal.com, which helps customers set up optimal repayment plans and track their progress.

NEXT: Goal: Build up the cash cushion