Market cap: $14.5 billion

2010 Revenue: $10.5 billion

P/E Ratio: 19.9

Dividend Yield: 0.1%

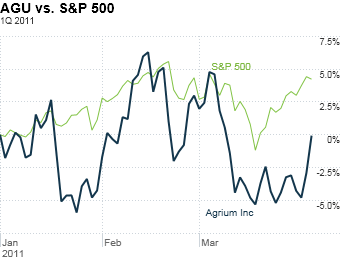

Stock price change for 1Q: 0.6%

Ticker: AGU

Agrium was supposed to perform well for the same reasons as Mosaic -- it's a fertilizer company that stands to benefit from the high price of crops fueling agricultural growth. Unlike Mosaic, however, Agrium's profits are more directly tied to the price of natural gas. Agrium needs the gas to make its main product -- nitrogen fertilizer.

But low gas prices don't necessarily equal smooth sailing for Agrium. According to an analyst report by J.P. Morgan, one risk of this is that low natural gas prices could spur competitors to start producing more nitrogen fertilizer, which could put pressure on Agrium's profit margins.

NEXT: Dow Chemicals

Last updated April 06 2011: 12:29 PM ET

Stock data as of market close, 03/31/11.