|

Brains, pluck, and bucks At WisdomTree, a high-powered partnership enters the ETF market.

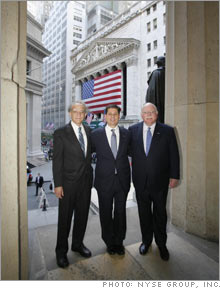

(FORTUNE Magazine) -- It sounds like a John Ford western. You have three characters: a tough, colorful veteran, a young gun with a chip on his shoulder, and a brainy guy. Throw 'em together, add a plot, and you have a movie, right? So here's the real-life Wall Street version: Legendary hedge fund manager Michael Steinhardt, Wall Street scion Jonathan Steinberg, and esteemed Wharton professor Jeremy Siegel have formed a posse.

The three amigos recently launched WisdomTree (Charts), a company that runs 20 ETFs, or exchange-traded funds. (An ETF is a low-cost way for investors to own a basket of companies that they can trade like a single stock.) Like many ETFs, WisdomTree's offerings are indexes. But instead of representing a basket of stocks weighted by market capitalization (like the S&P 500), its funds weight stocks by the amount of dividends companies pay. "Studies show that indexes have outperformed most active managers over time and that dividend-paying companies outperform non-dividend-paying companies," says Siegel, who has oft praised the virtues of indexes and dividends. "WisdomTree's products are designed to marry both together." Different ideas WisdomTree might have a familiar ring to students of Wall Street. It was the name that "Jono" Steinberg - the husband of CNBC's Maria Bartiromo and the son of Saul Steinberg, a onetime billionaire corporate raider - used for a previous company in the 1990s. That entity ran two hedge funds and some indexes. Back then Jono also owned Individual Investor magazine. But the magazine struggled and Jono was dogged by accusations that the publication touted stocks owned by his funds. So Steinberg, 41, shut down his funds, sold the magazine in 2002, and temporarily retired the WisdomTree name. He then spent three years looking for investors in his dividend index ETF business. "My idea was different, and so it was difficult to find a person or institution to back me," says Steinberg. "Everyone wanted to turn it into a hedge fund." Then, in Wall Street icon Michael Steinhardt, he found a willing partner. Over a 28-year run, Steinhardt averaged a 24% annual return after fees and made billions for investors in his hedge fund before shuttering it in 1995. (He also became embroiled in the Treasury bond scandal of the early 1990s and agreed to a $40 million settlement.) Said to be worth upwards of $700 million, Steinhardt, now 68, has recently focused on promoting Judaism among young people. He also tends to an immense private zoo in Westchester that includes zebras, capybaras, and a 600-pound tortoise named Sexton. Back to business "I have been approached oodles and oodles of times to come back into the hedge fund business," says Steinhardt. He has resisted the temptation. But after hearing Steinberg's pitch, he ponied up $7.2 million for a 44% stake in the company and elected to serve as chairman. Steinhardt explains: "WisdomTree's mission is 180 degrees different from what I did with my hedge fund, which was to make rich people richer. So little has been done that is of value to the average investor. This fit the bill better than anything I had ever seen. ETFs are low cost and transparent." Still, Steinhardt wanted an academic or a consultant to sign off on Steinberg's plan. Enter professor Siegel. Siegel not only vouched for Steinberg's approach but was so enamored of it, he signed up too. Siegel became a paid consultant and joined WisdomTree's board. How does Siegel feel about his new partners? "I know the questions about Jono and about Michael's Treasury bond thing, but I am extremely comfortable with Michael Steinhardt as chairman. And I believe in the idea. It just makes sense to stick with companies that are giving the cash back to their owners. There are no guarantees in this business or in life, but this is designed to work out over the long run, and in that time frame it's very persuasive." Ah, the long run. It'll be interesting to see if our three amigos ride off into the sunset together. |

|