|

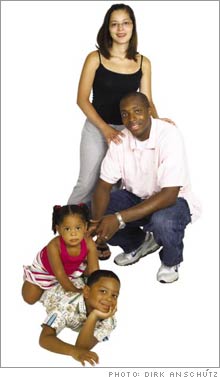

New home, fresh start This family dug deep to buy their first house. Now they want to build for the future.

(MONEY Magazine) -- For two years, Daniel and Tiffany Coward focused on buying a home. The high school sweethearts, living in a two-bedroom apartment with their two children in Queens, N.Y., put in overtime - Daniel as a cook in a luxury Manhattan hotel, Tiffany as a nurse on her hospital's night shift. They curbed spending: "When food is on sale, we buy it and freeze it," says Daniel. "I know the shelf life of things." And they saved 17% of their income.

Their effort paid off in June, when they closed on a four-bedroom house in Westbury, N.Y. for $463,000. Now that the Cowards have reached the first of their financial goals, they're wondering how to get started on the rest of them. "We were doing pretty well," says Daniel, "but the house completely wiped us out." Their emergency cash, which they tapped for the down payment, dwindled to $6,200. Their housing expenses tripled, with their $950 rent replaced by a $2,850 mortgage payment. Daniel and Tiffany, both 25, hope to retire in their fifties and cover at least half of the college costs for Brandan, 4, and Alexus, 2. But they don't know how they'll fit it all in. Where They Are Now Earning a total of $134,000, Daniel and Tiffany have a strong income, especially for their age. Although they haven't enrolled in their workplace retirement plans, they have a total of $28,900 in their Roth IRAs and a small-cap growth-stock mutual fund that they've earmarked for retirement. They also have $5,750 in their kids' 529 college savings accounts. Looking ahead, however, the Cowards know their savings rate will drop. Their new mortgage eats up 40% of their $7,000-a-month take-home pay, and the couple put $460 a month toward student loans. Tiffany doesn't want to cut the $150 that she and Daniel add monthly to the kids' 529s, so they plan to reduce their $900 monthly retirement contribution to $550. What They Should Do The Cowards have set ambitious goals, says Kay Conheady, a financial planner in Rochester, N.Y. Their new mortgage will make it hard for them to maintain even their reduced savings rate in the near future. They'll have to delay retirement until their sixties, she thinks, or boost their earnings substantially. In the meantime, she has advice for getting on the right path. RETIRE AT WORK The couple, says Conheady, should favor tax-deferred savings over taxable accounts. Tiffany, says the adviser, should open a 403(b) retirement account at work because her employer makes matching contributions. "Contributing enough to get the full employer match buys them free money, and they don't want to pass that up," she says. Once Tiffany gets the match, the couple can put any further savings into their Roth IRAs, where investments can grow, and be withdrawn, tax-free. Conheady thinks their regular Roth contributions will total far less than the annual limit of $4,000 per person. So it should be easy for the Cowards to funnel their $17,000 mutual fund account into the Roths. TAKE ON RISK Because the Cowards are young enough to ride out market cycles, Conheady recommends their retirement savings be a mix of 80% stocks and 20% bonds. Given the investment choices in Tiffany's 403(b), the adviser suggests they allocate 65% to an S&P 500 index fund, 15% to small-cap Royce Opportunity (RYPNX) and 20% to Vanguard Total Bond Market Index (VBMFX). For the Cowards' Roth IRAs, she suggests Vanguard Target Retirement 2035 (VTTHX) as a good starting point for low-cost indexing. Once their portfolio grows, they can add large-cap and small-cap value index funds to nudge it toward value stocks, creating a mix that Conheady prefers over the couple's more growth-oriented portfolio. PLAN FOR PROBLEMS While the Cowards do have life insurance, says Conheady, they need to protect against interruptions in their salaries. "Their new home is on the very upper end of what they can afford now, so they are highly dependent on the income of both individuals," she says. Tiffany already pays for disability insurance through her job; Conheady urges Daniel to buy it too. If he does, she says, they'll need to save only three months of living expenses in the emergency fund - about $15,000. Otherwise they should set aside money for six months. SCALE BACK ON COLLEGE Retirement, says Conheady, should rank ahead of college as a priority for the couple. So the Cowards should continue putting no more than a quarter of their savings into 529s. They can, after all, make penalty-free withdrawals from their Roths for their kids' education if they later decide that they don't need the retirement money. They should also roll their broker-sold Texas 529 plans into New York 529s, says Conheady, so they can cut costs and deduct contributions on New York State tax returns. Daniel was upset to learn that he was paying extra fees and losing out on tax advantages. But he and Tiffany aren't discouraged by the challenges Conheady outlines in her financial plan. "This gives us a starting point," he says. Want a Money Makeover? E-mail us at makeover@moneymail.com. More resources: Get your asset allocation right Walter Updegrave on retirement planning and smart money management |

|