(Money Magazine) -- Just as you were getting used to the Dow at record highs again, Richard Bookstaber - economist, hedge fund manager and onetime "chief risk officer" at Wall Street's Salomon Brothers - has something new for you to worry about.

In his book "A Demon of Our Own Design," he warns that the spread of arcane financial instruments - CDOs, credit swaps and a host of others - has made financial disasters unavoidable.

|

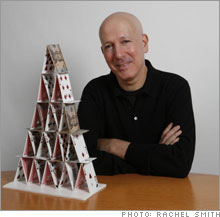

| Richard Bookstaber |

Unfortunately, he should know: He was an early adopter of portfolio insurance, a complex strategy whose unforeseen flaws triggered the '87 crash.

Question: You say that even as the economy has become more stable, markets have become more prone to breakdowns. Why?

Answer: The new instruments we're creating are so complex that no one understands how they'll react in shifting market conditions.

One result: You face risks that have nothing to do with the economy or the fundamental values of your investments.

For example, emerging market funds that held Brazilian bonds got hit during the Asian crisis in '97. Why? Big investors who bought Asian investments with borrowed money also held Brazilian bonds, which they had to unload as their Asian holdings came under fire.

It's hard to predict what might unfold in the future, whether 20% one-day declines as in '87 or something totally unanticipated. But crises are all but inevitable.

Question: Just last year the Amaranth Advisors hedge fund imploded, losing roughly $6 billion, and the markets shrugged it off.

Answer: I'm not saying every time something bad happens, things will cascade out of control. But the more blowups that don't lead to disaster, the more complacent we become.

Question: And regulation...?

Answer: The natural tendency is to come in after an incident and regulate. But all that does is increase the complexity of the system and push it more toward the edge.

Question: Jeez, this all sounds pretty bleak.

Answer: Actually, there's a bright side for individual investors. Unlike a pro who's judged on returns each month, you can wait out a crisis.

So take a long-term value approach, avoid the temptation to trade around - and you'll have an edge.