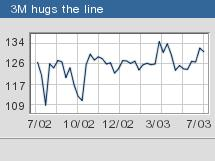

NEW YORK (CNN/Money) - Shares of 3M, best known as a maker of adhesives and abrasives, have shown a remarkable lack of traction lately.

As the overall market surged in the second quarter on renewed investor optimism, pushing the S&P 500 up nearly 15 percent, 3M's stock languished, falling 0.8 percent. It was one of only three stocks in the Dow to post a loss in the quarter.

And yet if the economic recovery really is coming, 3M stands to be one of the biggest beneficiaries. Demand for its products is so directly tied to the health of U.S. and global business that many investors have come to see the company as a proxy for where the economy is going.

"One of the first things I was taught in the business was that 3M is one of the best indicators of the economy there is," said Brad Ruderman, managing partner at the Beverly Hills, Calif.-based hedge fund Ruderman Capital Partners.

3M's businesses run the gamut, but what most of them boil down to is supplying other businesses with the things they need to operate daily. Post-It Notes for offices, packaging tape for shippers, drilling cements for energy companies. When companies around the world see demand improving, 3M starts making more sales right away.

"These guys are hugely captive to the economy," said Holland & Co. head Mike Holland, whose fund counts 3M as its largest equity position.

When business suffers, as it has over the past couple of years, the opposite is true. In 2001 3M's revenues fell by 4 percent. In 2002 they grew by just 2 percent. Thanks to cost-cutting efforts by management, the company's earnings held up well, dropping by 4 percent in 2001 but then bouncing back 17 percent last year.

These cost cuts mean that if 3M really does see significant revenue growth, the benefit to its earnings could be big. Because the company is running lean, its profit margins are already better than they were a couple of years ago. With lower fixed costs (like plant upkeep and labor) a larger portion of any increase in sales would fall to 3M's bottom line. It's an example of what economists call operating leverage, and it can be a powerful driver of profits.

Which is all very nice, of course, but why aren't 3M's shares rallying with the rest of the market?

"The fact that the stock hasn't been doing anything is curious," said Ruderman.

"Maybe it's telling us the recovery isn't there."

Or at least that the stodgy investors who tend to put money into things like 3M, as opposed to, say, Broadcom, are still very much in a show-me mode. Yes, 3M has seen sales gain ground over the past several quarters, with analysts pegging year-on-year revenue growth for the just-finished second quarter at 8 percent. But the manufacturers that make up a huge swath of its customer base are still badly mired.

According to the Federal Reserve, U.S. industrial production has shown no growth at all so far this year. The June reading on the Institute for Supply Management's purchasing managers' index showed a slight contraction in the manufacturing economy.

But a pickup in industrial production should begin to take hold over the next few months, thinks Lehman Brothers' chief U.S. economist, Ethan Harris. Tax incentives for buying capital equipment, generous financing terms and a weaker dollar should all help boost demand and send the economy on its way to recovery.

|

|  | Year* |  | Earnings growth |  | Revenue growth |  | 2001 | -4% | -4% |  | 2002 | 17% | 2% |  | 2003 | 12% | 8% |

|  |  |

| *2003 projected | | Source: First Call |

|

Feel like you've heard that one before and got burned for it? Sick of listening to economists? It might be worth your time to listen to what 3M has to say instead. Through all the false dawns, the company has continually struck a cautious tone with investors -- the thing about having your hands in so many of the economy's pots is that you know exactly how lousy things are. If you hear 3M finally say things are getting better, they probably are.

|