NEW YORK (CNN/Money) -

At this point everybody should know that the second quarter was good for earnings.

So far, companies have been beating expectations with relative ease, and there's no reason to think this won't continue as earnings season heads into its second big week. But already investors are looking to the future, wondering what results in the second half of the year will look like.

Very good, is the consensus among Wall Street analysts. According to First Call, earnings for companies in the S&P 500 are expected to post year-over-year gains of 13.1 percent in the third quarter and 21.2 percent in the fourth quarter, up from the 6.9 percent gain they're expected to post for the second quarter.

Such a good performance seems unlikely, says First Call analyst Joe Cooper, and estimates will probably be trimmed in the weeks to come.

No big surprise there -- company analysts have long had a tendency to be overly optimistic about future earnings. If there's anything odd, really, it's that the analysts haven't cut their third- and fourth-quarter forecasts by much at all over the past few months. This suggests that, from where the analysts sit, it really does look like the economy is queued for recovery.

Companies in this report: 3M; Texas Instruments; Ameritrade; UPS; Pfizer; Amazon; AOL Time Warner; Boeing; AT&T.

3M, Monday a.m.

Since the market first turned lower in 2000, 3M shares have done something few other stocks have done -- they've risen.

It was a neat trick, particularly for a company whose businesses are so closely tied to the economy that many investors have taken to watching it to get a read on where things are headed. Perhaps because it had its finger on the economy's pulse, 3M put through a series of cost-cutting measures that helped it maintain earnings even as sales languished.

But now some investors worry that the company has nothing left to cut and that it won't be able to parry the blow if the economy continues to suffer. Others say that, because 3M's stock has done so well, it has little room for upside. At the moment, the only way it seems the company could silence its critics is to say that it is seeing real signs the economy is turning, and that it believes its businesses are going to be big beneficiaries of the recovery.

Why it matters: Many of 3M's divisions are in the business of supplying companies with the things they use every day, like Post-It Notes and sandpaper. As a result, when the economy really does get better, 3M knows it right away. If the company says the clouds are finally clearing, you can be sure they are.

First Call forecast: $1.51 a share versus $1.34 a year ago.

Texas Instruments, Monday, p.m.

After Intel, Texas Instruments is probably the semiconductor company most closely watched for implications for the broader technology sector. The company is the largest maker of chips for cell phones, so the health of its business speaks to the health of the broader semiconductor and telecom sectors.

Telecom has been slammed in the bear market of the last three years. The firms that sell cell phones have been plagued by excess capacity, sluggish demand, and increased competition from companies in China and other countries that can make the same products, only cheaper. The SARS virus also had an impact on Asian sales in the second quarter.

In response, TI, like many in the telecom space, warned last month that second-quarter results would sharply miss estimates. Judging from the recent spate of weak earnings and forecasts from companies such as Motorola, Nokia and Lucent Technologies, the trouble with telecom is not going to ease anytime soon.

In recent days, Nokia, which accounts for 12 percent of TI's overall sales, reported a weak quarterly profit and warned that the rest of the year will remain tough.

Why it matters: After already warning about its sales during a period when very few tech bellwethers were warning, if TI now misses its lowered estimates, there could be a panic that its business is having a tougher time than even the company had realized.

What's more significant is what TI has to say about the third and fourth quarters, and whether it sees any pickup in demand. Judging from what its customers and sector mates have already said, its unlikely TI will buck the trend.

First Call forecast: 6 cents per share, unchanged from a year earlier.

Ameritrade, Tuesday a.m.

The four-month-and-counting stock rally has been good for Ameritrade and other discount online brokers, bringing in more accounts and improved trading volume, lifting profits and the stock price.

In May, the most recent month for which numbers are available, accounts at Ameritrade grew by 37,000, due partly to the rally and partly to a purchase of rival Mydiscountbroker.com, which brought in 20,000 new accounts.

Average daily trading volume has grown, too. This is key, as it means both that the company is making more money from trading fees, and that the so-called small investor is becoming more active. Ameritrade's average trading volume in the first quarter was 116,000 trades, but in May, daily volume was 157,000 trades.

As a result of this, Ameritrade raised its fiscal third-quarter earnings and revenue forecasts in mid-June and analysts soon followed suit.

However, soon after, Nasdaq volume started to ebb. If Ameritrade says that early July volume showed erosion as well, that could be bad news for the individual investor, the stock rally and Ameritrade's business.

Why it matters: You want evidence that the individual investor is back? Look no further than the online discount brokers.

If Ameritrade's business and trading volume are growing, that suggests Americans are confident enough about the market to get back in, and to do it by picking their own stocks, rather than just relying on managed funds. In addition, what the results say about which individuals are getting back in is important for the rally. Is it just the semi-professional day trader, who has been back for much of the rally anyway, or is the reluctant "Main Street" investor finally jumping in?

First Call forecast: 10 cents a share versus 3 cents a year ago.

UPS, Tuesday a.m.

UPS is expected to show a gain in earnings year-over-year for the second quarter, but those earnings will be a bit deceiving. During the second quarter of 2002, UPS was pressured by concerns about a possible Teamsters union strike.

As a result of the worry, some customers took their business elsewhere. Analysts will therefore be looking at results from UPS's core domestic business to learn if it has recovered in the past two quarters, when earnings were off on relatively flat revenue, hurt somewhat by the weak U.S. economy and difficult winter weather.

Despite the U.S. decline, UPS has managed to beat expectations in the most recent two quarters, buoyed by revenues from its international and non-package businesses, such as recent acquisitions Mailboxes, Etc. and Fritz Cos.

The company, which issued a series of warnings in 2001 and 2002, reaffirmed its fiscal guidance for the full year in April. Its international business has shown increasing strength, up 24 percent last year, and analysts will be looking for signs of continued growth in overseas markets.

Why it matters: UPS's international and non-package businesses are doing well. But three-quarters of its revenue still comes from its core domestic package business, and analysts will be looking to see if that business is ready to join the party. Four of the last five quarters have shown a decline in profit in the domestic package business, and while the other units have been enough to help UPS beat forecasts, they can't do all the heavy lifting themselves.

If the company's core domestic business shows growth after a difficult four quarters, it could be a good sign for more than UPS -- the company, which moves an estimated 6 percent of the gross domestic product in its brown trucks, is a bellwether for overall business activity in the nation. Continued weakness in this area could be a sign of ongoing weakness in retail business -- and in the overall economy.

First Call forecast: 59 cents a share versus 54 cents a share a year ago.

Amazon, Tuesday p.m.

Despite walking on shaky ground for a while, Amazon has stood strong in the online survival-of-the-fittest battle. The company consistently cut its net losses year-over-year and turned them into profit for the first full year in 2002.

Shares of the Internet poster child's stock have skyrocketed this year, rising about 92 percent since the start of 2003, but some say the stock is due for a severe pullback. The naysayers claim valuation – Amazon currently has a P/E of 84.4 -- is extremely high and that Amazon's earnings and growth can't support it.

But, Amazon's first-quarter earnings came in at 10 cents a share, which blew away Wall Street's 6-cent forecast. And Wall Street is calling for a 35 percent rise in 2003 earnings over the previous year as the company continues to snatch market share from other online retailers and brick-and-mortar stores.

Why it matters: Amazon needs to put up strong earnings numbers and show real signs of growth in order to justify the run-up in its stock price and high valuation – and to solidify investor confidence. Because it put up such good numbers in the first quarter, the market could see a mediocre report as a bad sign.

First Call forecast: 6 cents a share versus a penny-a-share loss a year ago.

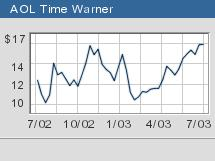

AOL Time Warner, Wednesday a.m.

AOL Time Warner shares have shown a nice recovery since the beginning of the year, when the company reported the largest loss in corporate history. Ted Turner, it largest individual shareholder, sold much of his stake, and a shareholder revolt forced America Online co-founder and AOL Time Warner Chairman Steve Case to quit.

Part of the reason for the roughly 25 percent gain in shares since the end of 2002 is the rising tide -- Nasdaq is up 27 percent over the same period. Part of it is a better environment for the company's less publicized units -- the advertising market has improved and some of its movies, such as "Matrix Reloaded," have captured big box office.

But the problems that worried and angered some investors so much in January and early February -- the company's heavy debt load, problems at the America Online unit and worries over ongoing Department of Justice and Securities and Exchange Commission investigations -- are still there to cause problems for AOL Time Warner, the parent of CNN/Money, in the long run.

First, although it has reduced debt, the planned spinoff of its cable assets -- slated for the second half of the year -- is very much up in the air. CEO Richard Parsons has conceded the spinoff probably is on hold until the SEC probe is completed. And the bidding for other units has been disappointing. The company pulled its book-publishing unit off the market for lack of acceptable bids in May. On the positive side, AOL Time Warner announced Friday the $1.05 billion sale of its CD and DVD business.

Second, although accounting is not the hot-button issue with Wall Street it was a year ago, it doesn't change the fact that AOL could still get hit with a substantial levy from the SEC and face shareholder lawsuits for years to come.

The company's biggest issue, however, is a lot more basic: How is it going to grow? The America Online division continues to bleed dial-up customers and is having trouble moving into the high-speed Internet market. Even if the economy really does improve, it's hard to see how the company's other divisions -- which don't function nearly as synergistically as suggested by the now-departed architects of the troubled merger -- are going to pick up the slack.

Why it matters: While shareholder pressure has lessened in recent months, AOL's businesses still need to show signs of improvement or else there will be renewed pressure to undo the 2001 merger that drove down the value of the stock while driving up debt and losses. The new management team, including America Online chief Jonathan Miller, is on a relatively short leash to come up with solutions for the troubled AOL unit.

First Call forecast: 10 cents a share versus 9 cents a year ago.

Boeing, Wednesday a.m.

Boeing's main business, manufacturing commercial planes, is in a funk and, with the airline business still in disarray, it doesn't look like it's going to get better anytime soon. Boeing's commercial plane deliveries fell to 381 last year from 527 in 2001. This year, it's forecasting 280, but even that may be a stretch. Recently, Continental Airlines decided to defer delivery of most of a $2.5 billion order for Boeing planes until 2008.

Most recently, the company announced it would take second-quarter charges of $1.1 billion, due to lower demand for satellite launch services and higher mission costs. As a result, analysts lowered their earnings estimates for the quarter from a profit of 45 cents a share to a loss of 43 cents a share.

It hasn't been all bad news for Boeing, however. Military aircraft and missile systems -- its second-biggest division -- has been growing, thanks to increased defense outlays from the government.

Why it matters: Some Wall Streeters think that we are in the midst of a major sectoral shift and that defense will be one of the best performing sectors for years to come. The reason? Money that might in more peaceful times go into the private economy is going to get earmarked instead for the military. If that's where the world is heading, Boeing will want to keep shifting focus away from commercial airlines and toward defense.

First Call forecast: A loss of 43 cents per share versus a profit of 92 cents a year ago.

AT&T, Thursday a.m.

Aggressive competition in the beleaguered long-distance telephone service industry has left Ma Bell scrambling to find ways to grow its revenue and earnings per share over the last three years. Not to mention its stock price. With a more than 27 percent decline year-to-date, AT&T is the worst performing Dow stock this year and is also the third worst-performing S&P 500 stock.

The company's timing in terms of business initiatives over the last few years has not been ideal, either. Its recent spinoff of AT&T Wireless and the sale of its cable assets were supposed to streamline the business, but instead left it in a less competitive position as it now struggles to remain relevant without the technologies of the future.

AT&T's debt also remains a problem. The streamlining of its business helped it cut its debt load, but not enough. Both Standard & Poor's and Fitch recently cut their debt ratings on AT&T, saying that the outlook on the $18 billion the company owes its creditors is still negative and that they expect the company's business to continue to be burdened by the lack of a corporate spending recovery.

Why it matters: A Dow stock and a recognized name brand, AT&T was once the hero of widows and orphans, a reliable company that you could include in your portfolio without fear. That's true no more, but everybody and their mother still own the stock.

The main reason AT&T's earnings matter is perhaps the fact that they don't matter anymore. A better harbinger of the health of the telecom industry might come from Verizon or any of the other Baby Bells due to report in the next week.

AT&T is forecast to show an increase in earnings per share, but this is largely due to things like cost-cutting, rather than revenue growth. Revenue for the quarter is, in fact, forecast to decline.

First Call forecast: 53 cents per share versus 35 cents a year earlier.

Pfizer, Friday a.m.

Pfizer had a lot in the works in the second quarter, the biggest of which was the finalization of its purchase of Pharmacia for $60 billion on April 16.

Pharmacia brings a whole host of new products to Pfizer, including household names Rogaine and Nicorette as well as its leading overactive bladder treatment, Detrol. But, investors will be looking for evidence that the purchase hasn't diverted Pfizer's focus and that Pharmacia's integration is going smoothly.

While some critics question whether the top pharmaceutical company has become too big for its own good, there have been positive signs that it is continuing to produce. Last month, Pfizer unveiled an experimental drug, Varenicline, to help people quit smoking, which could become its next blockbuster.

| Related Stories

|

|

|

|

|

Also, big drug companies continue to be challenged by the growing generic drug market. But, of Pfizer's own top sellers, Lipitor keeps its patent until 2010, Viagra until 2011 and Celebrex until 2013. However, it does face competitors abroad, and analysts will be closely watching sales of Viagra overseas as an indication of future sales at home.

Why it matters: While Pfizer has steady growth rates and the drug sector has done well in the market in recent months, the company needs to prove that its integration of Pharmacia hasn't weighed more than expected on its earnings. Because of its success with prior buyouts and sales, the company could be more vulnerable to expectations.

Prescription drug growth across the industry has been declining, according to analysts, and it will be important for Pfizer's numbers to show that sales of blockbusters like Viagra and Lipitor haven't dropped significantly.

First Call forecast: 29 cents a share versus 32 cents a share a year ago.

|