NEW YORK (CNN/Money) -

Chip stocks continue to lead the tech rally...but for how long?

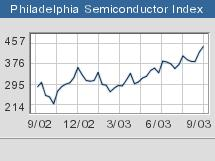

The Philadelphia Semiconductor Index is up 5 percent since Intel raised its third-quarter sales guidance on Aug. 22, and the index is now up nearly 58 percent year-to-date.

But investors will be looking closely at National Semiconductor's fiscal first-quarter earnings report on Thursday afternoon as well as Intel's mid-quarter update after the bell Thursday for clues as to how real this recovery is.

National Semiconductor (NSM: Research, Estimates), which makes analog chips that convert things like sound and light waves into digital signals, is a turnaround story. The company is expected to post a slight sales decline for its fiscal first quarter, which ended in August, but the key thing to look for will be its outlook for future sales.

Adam Parker, an analyst with Bernstein, said he expects National Semiconductor to increase revenue guidance for its fiscal second quarter. Analysts expect 4.6 percent growth from the first quarter, but Parker thinks management will project growth a few points higher than that.

Waiting for more positive pre-announcements

That would be encouraging news because so far, few companies have raised guidance besides Intel. On Tuesday afternoon, chip company Altera (ALTR: Research, Estimates) reaffirmed its third-quarter sales guidance, and on Wednesday morning, Fairchild Semiconductor (FCS: Research, Estimates) did the same.

And even though it's clear that things are getting better for chip companies, the stocks have already rallied in anticipation of better times ahead. So just reaffirming guidance won't be enough to satisfy Wall Street.

"Investors are hoping for good trends, but nobody is going out on a limb. If chip companies can't start raising numbers soon, it's going to be difficult to support these valuations," said Woody Calleri, an analyst with FTN Midwest Research.

| Related stories

|

|

|

|

|

According to Thomson/Baseline, stocks in the S&P semiconductor industry group trade at an average of 65.6 times 2003 earnings estimates and 35.2 times 2004 earnings estimates.

Intel (INTC: Research, Estimates) is unlikely to raise guidance again when it gives its regularly scheduled mid-quarter update, analysts said. That's because it's too soon to tell how strong September will end up. For chip companies, September is when a large percentage of the quarter's orders are made. That's why many companies, including Intel, have remained somewhat cautious.

"The level of optimism of companies coming out of July and August is reasonable," said Barry Randall, manager of the First American Technology fund, which owns chip stocks Intel, Texas Instruments (TXN: Research, Estimates), Taiwan Semiconductor (TSM: Research, Estimates) and Amkor (AMKR: Research, Estimates). "It's easier to beat August sales targets since they are traditionally quite low."

Is demand for real?

So a healthy dose of skepticism is still warranted when looking at chip stocks.

The Semiconductor Industry Association reported Tuesday that sales of chips in July increased 2.9 percent from June and 10.5 percent from a year ago. But FTN Midwest's Calleri said the most crucial question facing chip companies is whether this a sign of an actual pickup in end demand for devices like PCs and cell phones or if hardware companies are just building inventory in the hopes that demand will be there.

The danger of the latter scenario is that if hardware companies get stuck with unsold inventory, this would limit demand for new chips in the beginning of 2004.

The market doesn't seem to be worrying too much about this just yet.

"Is it inventory or is it growth? We're not going to find out until December. I'm leaning toward inventory," said Calleri. "But right now I don't think investors care."

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies.

|