NEW YORK (CNN/Money) -

The biggest mistake an investor can make with a stock that's had an amazing run is to try to call a top when its business remains strong.

Take Apple Computer, for example.

Back in late April 2003, when the company was about to launch its iTunes online music store, the stock was trading at about $13 a share. That was only slightly higher than the amount of cash Apple had, on a per share basis, on its balance sheet.

Since then, the stock has nearly tripled. And I've written several bullish stories about Apple, even though it might seem there could be no more upside left.

I said I still liked Apple in mid-May when the stock was at about $27. I professed my undying love for the stock again in late August, when it had hit $32.

And now that the stock is approaching $40, I still don't think it's time to call this one wormy Apple. Here's why.

Even though more competitors are angling into the crowded online music business, Apple's iPod (the hardware) and iTunes (the software) remain the standard for digital music.

The company is no longer nearly dependent on the Mac as it once was. As such, Apple has continued to post better-than-expected financial results, and skeptical Wall Street analysts have had to keep raising their earnings estimates.

And Apple did it again on Wednesday, reporting fiscal fourth-quarter results that were well ahead of analysts' expectations. Earnings came in at 27 cents a share on sales of $2.35 billion. Wall Street was forecasting a profit of 18 cents a share and revenues of $2.15 billion.

What was most remarkable about the results was that Apple said it shipped more than 2 million iPods in the quarter, up six-fold from a year ago. And sales of iPods, software and peripherals -- essentially the non-Mac part of Apple's business -- accounted for nearly half of the company's total sales, compared to just 30 percent in the same period last year.

Estimates rising: Like them Apples?

When I wrote my May column about Apple, I noted the consensus earnings estimate for fiscal 2005 was 77 cents a share, up from 60 cents a share in mid-February. Now, analysts expect earnings for 2005, which ends next September, to come in at 94 cents a share.

|

|

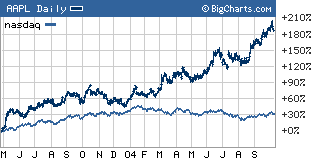

| Apple has been on an incredible ride since iTunes was launched in April of 2003. |

That number is likely to go up sharply again since Apple said it expects first quarter earnings to be between 39 cents and 42 cents a share. The consensus estimate for the first quarter was 28 cents.

With that in mind, Apple's stock still doesn't appear to be overpriced.

Sure, it's not cheap, at about 40 times 2005 estimates.

But after factoring out the company's $5 billion in cash, Apple's actual business is valued at 27 times earnings estimates -- feasible for a company that is expected to post a profit increase of 44 percent in fiscal 2005.

What's more, the fiscal 2005 projected earnings increase is on top of expectations of a more than three-fold increase in profits for the current fiscal year.

| Recently in Tech Biz

|

|

|

|

|

Apple is a rarity in the tech sector right now -- a company that doesn't appear close to hitting a peak in its sales or earnings cycle.

And trends in tech favor Apple more than companies with more exposure to corporate demand, said Darcy Travlos, an analyst with Caris & Co. (She doesn't own the stock and her firm has no banking relationship with Apple.)

Travlos said iPod is just the tip of the iceberg, noting its success is part of a larger trend in tech: the desire by the consumer to manage and create all forms of digital content.

"The last tech cycle was driven by (businesses adopting) networking but I think this tech cycle will be more consumer driven," said Travlos. "Investors need to look at the larger picture of what Apple is accomplishing. Apple is going to do for personalized content management what Microsoft did for the office."

If she's right, there's no reason to expect Apple's earnings and sales growth to taper off anytime soon. And that means there's no reason to expect the stock to slow down in a material way either.

The Tech Biz Baseball Bet: Finally, it's time to talk about a topic far more important than tech stocks -- the Yankees-Red Sox American League Championship Series. My TechBiz colleague Eric Hellweg hails from Beantown, so we've decided to have a friendly little wager.

After the Yanks win the ALCS, Eric will send me a quart of tasty New England clam chowdah. But if, for some reason, the curse of the Bambino is lifted, I will send Eric a dozen Noo Yawk bagels.

May the best team win. Go Yanks!

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

This is an update from a column that originally ran on Oct. 12.

|