|

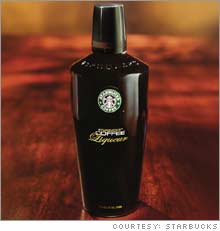

| Starbucks launched its first alcoholic drink in February |

|

|

|

|

|

NEW YORK (CNN/Money) -

Pax World Funds said Wednesday it sold 375,000 shares of Starbucks worth about $23.5 million because it disapproves of the gourmet coffee chain developing an alcoholic beverage.

"The company essentially forced our hand in this matter," Anita Green, vice president of social research at the socially conscious mutual fund group, said in a statement. "We have divested ourselves of these shares reluctantly and only after trying to get the company to reconsider its course of action."

"Investors in Pax World Funds expect us to do what we say we will do about avoiding companies that produce liquor," she added.

Seattle, Wash.-based Starbucks (Research) in February unveiled a coffee liqueur, its first alcoholic drink. Priced at $23 for a 750 milliliter bottle, the liqueur is to be sold only in restaurants, bars, and liquor stores and not in its coffee houses.

The Starbucks Coffee Liqueur was made in collaboration with Jim Beam, a unit of Fortune Brands.

According to Pax World's investing mantra, the funds seek to invest in companies that produce goods and services that "improve the quality of life such as health care, technology, housing, food, education ... and that are not engaged in the manufacture of defense or weapons-related products or that derive revenue from the manufacture of tobacco, liquor, or gambling products."

Pax said Starbucks represented 1.6 percent of the Pax World Balanced Fund (Research) portfolio as of December 31, 2004.

For its part, Starbucks said it was "disappointed" in the fund company's decision. "However we acknowledge that Pax World Funds has a strict policy that it will not invest in companies that derive revenue from the manufacture of liquor," Starbucks spokeswoman Audrey Lincoff said in a statement e-mailed to CNN/Money.

"Starbucks Coffee Liqueur is intended for adults of legal purchase age seeking a premium quality liqueur beverage," she added.

Click here for more news on Fortune 500 companies.

|