|

Lenovo's Big Blues

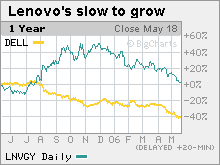

China-based company is doing a good job integrating IBM's PC business, analysts say. So why is its stock down 26% this year?

NEW YORK (CNNMoney.com) - When Lenovo announced early last year that it would buy IBM's personal computer business, the company's shares surged. But the American depository receipts (ADRs) of the Chinese company have fallen 26 percent since the start of the year, despite what industry analysts view as a largely successful integration of the IBM (down $0.51 to $80.15, Research) PC business. Lenovo (down $0.10 to $6.80, Research) is the number one PC vendor in China, one of the world's fastest-growing markets for PCs, and ranks third overall, according to industry researcher Gartner Group.

The share price has also faltered in the face of strong performance from China and the contribution of IBM's PC business, which is posting profits after years of losing money under Big Blue. Lenovo, which has headquarters in Beijing and Raleigh, N.C., will report its annual results May 25. More market share, more problems

Buying IBM's PC business gave Lenovo an instant footprint in the U.S. market, but it presented big challenges as well. IBM lost $1 billion on PCs between 2001 and 2004, according to analyst Martin Kariithi of Technology Business Research. Lenovo also inherited customers in Europe and Japan, areas that analysts say are suffering from slowing demand. "There is a lot of uncertainty, because to date they have not been as successful as you might have thought in turning around the IBM business," said Kariithi. "Right now their best results are still coming from China." Kariithi said another big problem IBM had with the PC business was that its expenses were too high. He thinks Lenovo's decision to hire William Amelio away from Dell (up $0.58 to $24.53, Research) as its president and CEO should prove to be a smart move for the company, given Dell's traditionally strong reputation for cost management. Also, the company announced a restructuring plan in March that included 1,000 job cuts, a move the company expects will save roughly $250 million in costs when the dust settles. The move temporarily perked up the price of the company's ADRs, sending them as much as 6 percent higher the week after the announcement. Simon Yates, an analyst at technology research firm Forrester Research, said in addition to inheriting IBM's hefty cost structure, Lenovo had to start competing on price to keep IBM's core base of large corporate customers from defecting to rivals Dell and Hewlett-Packard (down $0.34 to $32.14, Research) after the acquisition. Yates thinks the strategy is working, with many companies who had been thinking of switching away from Lenovo deciding to stay the course. But it may have had a negative impact on short-term profits. "They (were) selling machines at no profit because they had to gain share and build a brand," said Yates. At the same time, the company is targeting markets beyond IBM's main focus of large corporate customers by moving into the small- and medium-business market, which analysts say is more price sensitive than the market for large corporate customers. The upside of going after small and medium businesses is that it's a faster-growing market than the large business market, according to Kariithi. But the move also puts them up against entrenched competitors like Dell and HP, which can trade on years of brand recognition -- an issue the company will also face if it ever decides to target the consumer market in the U.S. And analysts say that fears about how tough competition is in the PC business may be one reason why Lenovo's stock has taken a hit this year. After all, industry leader Dell has been struggling as well. Dell, like other PC makers, has suffered due to increased competition from a resurgent Hewlett-Packard and recently said it will begin slashing prices. That should affect other PC makers as well. "The whole industry is under tremendous pricing pressure right now," said Yates. There are also concerns about slowing growth in the PC industry overall. Industry tracker IDC estimates that PC shipments are expected to increase 10 percent a year for the next several years down from growth of over 15 percent a year during the past two years. Emerging markets a bastion of growth

Still, Lenovo stands to gain from its position in fast-growing PC markets such as China and India. About 50 percent of the company's total shipments come from the Asia Pacific region, according to IDC. "In emerging markets, they are the best positioned PC vendor right now," said Kariithi. But he noted that the company won't reap those benefits for another three or four years, a view seconded by Forrester's Yates. "We think that there will be about 500 million new PCs in the 50 or so largest emerging markets - it's an enormous growth market, but it's also a high-volume, low-cost market," he said. "There's not a great deal of profit margin in those markets until they mature." The analysts quoted in this story do not own shares of the companies they discussed. ----------------------- Dell to get served by AMD: Read more here. |

|