|

Sexy summer picks: Google and Yahoo

Internet stocks typically slump during the sleepy summer months, but some see a buying opportunity.

NEW YORK (CNNMoney.com) - As the weather gets nicer, even the most devoted Internet users find other ways to keep themselves busy. For that simple seasonal reason, online companies like Google and Amazon.com tend to report more sluggish growth during the second quarter and third quarters of the year, which include the spring and summer months. And Internet stocks have also typically followed such a pattern, cooling off during June, July and August before picking up at the end of the year in anticipation of strong fourth quarter results. This year though, Internet stocks are heading into the sleepy summer months on a losing streak. With that in mind, some analysts think shares of Net leaders are a compelling buy sooner, rather than later. Summer slump priced in?

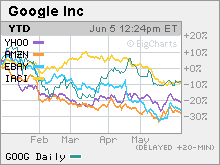

Shares of Google (Research) and Barry Diller's IAC/InterActive (Research), which owns Ask.com, have each declined 8 percent. Yahoo! (Research) is down nearly 20 percent. And shares of online commerce companies eBay (Research) and Amazon.com (Research) has plunged about 25 percent. "There is no question there will be seasonality when it comes to the second and third quarters. However, Internet stocks have been underperformers year-to-date," said Scott Kessler, an equity analyst with Standard & Poor's. "We're recommending a number of these stocks because nothing has changed in the outlook." Kessler argues that a big reason behind the sell-off in Net stocks this year are fears of a slowing economy, higher interest rates and rising energy prices. In other words, concerns affecting the entire market are also hurting Internet companies, not a notable deterioration in fundamentals for these companies. That's particularly the case with companies in the online advertising business. According to figures released last week by the Interactive Advertising Bureau and PricewaterhouseCoopers, Internet ad sales in the first quarter rose 38 percent from a year ago and hit a new record of $3.9 billion. Kessler points to continued new product roll-outs by Google, IAC's revamped Ask.com and Yahoo's recent online advertising alliance with eBay as healthy signs in the online advertising sector. David Garrity, director of research with Dinosaur Securities, a New York-based brokerage firm, agrees that overall investor skittishness is a big factor behind the online sectors' recent weakness. But he thinks that eventually, sentiment will shift back towards Internet companies since they will prove that they are still on track to post robust levels of sales and earnings growth even if the economy does cool off. "In the context of a decelerating global economy, people will look for growth stories where they can hide out," he said. Martin Pyykkonen, an analyst with Hoefer & Arnett, adds however that if the economy does soften, investors do have more reason to be worried about the effect on Amazon.com and eBay since their fortunes are tied more closely to consumer spending, not online advertising. Valuations no longer absurdly expensive

But Garrity said he would not be surprised to see merger rumors pick up during the next few months, which could lift the whole sector. He said last month's eBay-Yahoo partnership has raised the possibility that eBay could eventually be taken over by Yahoo or even Microsoft (Research). He added that Chinese Internet search advertising leader Baidu is another company that is likely to benefit from takeover speculation. "The possibility of consolidation should give downside protection for these stocks and make them a relative safe haven," he said. And Kessler points out that several Internet leaders are also now trading at reasonable valuations as a result of this year's pullback. eBay and IAC are two in particular that he points out. eBay trades at about 32 times earnings estimates for 2006 and profits are expected to increase at about a 25 percent clip a year for the next few years. IAC trades for just 18 times this year's profit projections and analysts are forecasting annual earnings growth of 15 percent for the next few years. Clayton Moran, an analyst with Stanford Group, said that Google, despite its triple-digit stock price, is also an attractively valued stock. Shares trade at about 40 times 2006 earnings estimates, which is not cheap. But earnings are expected to increase by about 30 percent a year for the next few years so Moran thinks it is reasonable. "Google suffers form a perception that the stock is expensive but that is misguided because the stock is up a lot. Those are not the same things," he said. "For an industry leader like Google, the valuation is quite compelling." Google and Yahoo aren't the only two companies that could benefit from continued strength in online advertising either. Moran said two smaller online marketing firms -- 24/7 Real Media and Marchex -- look attractive. Hoefer's Pyykkonen said ValueClick and aQuantive are also positioned well as long as search-based advertising remains hot. Still, Moran said investors should not rush into any of these stocks with the hopes of making a quick buck. Although he thinks the worst may be priced into Internet stocks, he does not think they are primed for a summer rally. "These companies are cheaper than they were just a few months ago but the likelihood is the seasonal slowness in the operations will be reflected in the stocks," he said. But as long as investors have a longer-term horizon in mind, Pyykkonen said now is a good time to take a look at companies like Google and Yahoo. He said that concerns about whether online advertising momentum is slowing will dissipate once the temperatures start to dip. "If you look at the past couple of years, if you wait too long in the fourth quarter before buying, you miss the boat," he said. _____________________ For more about the new Ask.com, click here. For a look at more Internet stocks, click here.

Analysts quoted in this story do not own shares of companies mentioned and their firms have no investment banking ties with the companies. |

|