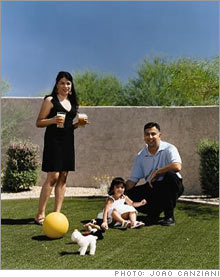

What works: Planners prosper People who go through the trouble to craft a plan end up with far more savings. See how it worked for Rob and Sucheta Shah.

NEW YORK (Money Magazine) -- The simple act of planning - calculating a retirement target, say, or estimating how much you should save - has a surprisingly large impact on your odds of success. Consider the results of a study by Annamaria Lusardi, a professor of economics at Dartmouth College, and Olivia Mitchell, a professor of insurance and risk management at the University of Pennsylvania and executive director of the Pension Research Council.

Analyzing data from a 2004 national survey on the first wave of baby boomers, Lusardi and Mitchell found that those who did "a lot" of retirement preparation had a median net worth of $200,000, compared with $84,000 for those who did the least. "Even a small amount of planning can make a huge difference," says Lusardi. Those who did "a little" were also ahead, with a median net worth of $172,000. Planning pays off because it's a crucial psychological trigger. Studies show that writing a plan down - or even simply thinking about it - greatly increases the likelihood that you will follow through. "Planning helps us overcome the internal blocks that lead us to procrastinate or worry," says Dr. Richard Peterson, a psychiatrist and author of the upcoming book "Inside the Investor's Brain." And any facts you pick up along the way may motivate you or scare you into action. Thinking about the future was enough to make Rob and Sucheta Shah, now 36 and 35, serious about retirement from an early age. "I figure Social Security won't be there for me when I'm 65," says Rob. "So we have to take charge of our destiny." The Scottsdale couple became self-taught investors - he's a manager at a consumer products company, and she's a former wedding planner who now stays home with two-year-old daughter Simran. Using online calculators, Rob figured they would be on track if he regularly stashed away 4% of his income in his 401(k), where he receives a 4% match, and saved another 11% in a taxable account. Rob recently raised his 401(k) contribution to 10%. Fourteen years into their plan, the Shahs have $150,000 saved. What to do now What to do now: If you don't already have a plan, a good first step is to come up with a savings goal. Your 401(k) Web site should have a savings calculator, and most major fund companies offer similar tools online. If you want advice, you can buy a personalized retirement plan from a fund company such as T. Rowe Price (800- 638-5660) or Vanguard (800-851-4999), typically for $250 to $500. _________________________________ How to make your nest egg last a lifetime Some people like the do-it-yourself approach. Others may prefer the lifelong promise of annuities. Money's Walter Updegrave lays out the perfect compromise. 7 stocks for the really long run The best investments are the ones you can hold for decades. You'll lower your tax bill and your trading costs - and maximize your chances for great returns. Money's Michael Sivy identifies the most promising. |

| |||||||||||||