NFL, the hedge fund Nation's richest league to get even richer taking stock, rather than just cash in its sponsorship deals. NEW YORK (CNNMoney.com) -- The National Football League is probably the most lucrative sports league the world has ever known. As a portfolio manager, it might be even better. The league has long been great at raking in billions of dollars from deep pocketed partners such as General Electric (Charts), Walt Disney (Charts) and Motorola (Charts).

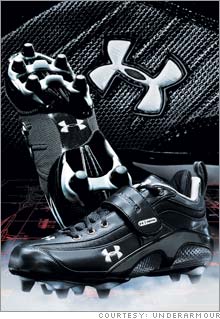

Recently it has learned how to maximize value from smaller business partners by taking stock or warrants instead of just cash. The league then shares in the lift the smaller companies get from their relationship with the nation's most popular sport. In the latest such deal, athletic apparel maker Under Armour (Charts) signed a deal with the league in August to make it an authorized supplier of players' cleats. The deal is reported to pay the league $50 million over six years. The deal also allows the league to buy 480,000 shares of the company's stock at a price of $36.99. Those rights could conceivably give the league just less than 2 percent ownership in the company, based upon current shares outstanding. As of Friday, Under Armour shares were up about 9 percent in the two months since the deal was signed. The NFL and Under Armour decline to comment on the deal beyond what has been disclosed in statements and filings, as have other partners involved in such stock deals. The NFL's other similar current stock deal was reached in January 2004 with Sirius Satellite Radio (Charts), which signed a deal to carry NFL games on its service. That broadcast deal reportedly will have Sirius pay the league $220 million over seven years. But while the deal appears to be less lucrative than the 11-year, $650 million deal Major League baseball signed with Sirius competitor XM Satellite (Charts), the NFL may end up doing better due to its returns on Sirius stock The league got 15.2 million shares of Sirius stock, as well as warrants priced at $2.50 to allow it to buy an additional 50 million shares. The shares, now worth about $59 million, have risen more than 40 percent in value since that deal was signed, and the warrants would produce a $69 million profit for the league if they could all be exercised today, equal to a 56 percent return. The league profited from its one previous stock warrant deal. Reebok granted the NFL 1.6 million warrants when it signed a deal in 2001 to become the official supplier of all game day apparel used by the league. When Adidas bought Reebok in 2005, the NFL cashed out those warrants and netted $25 million. Admittedly the $25 million from the Reebok deal, or even the $128 million paper profit in the Sirius stock deal is barely enough to get the 32 NFL owners to notice. Some of the owners are doing well enough that it's tough to imagine them bothering to bend over to pick up any check that doesn't have at least seven zeros attached to it. But the deals are smart moves for both the league and the companies involved, said sports marketing consultant Marc Ganis of Sportscorp. "I don't know of anyone who has done this kind of deal other than the NFL," he said. "But it's smart for the NFL. It's not the kind of thing they're going to do with a mature company like GE. But they're putting these other companies on the map, or helping a company that had been struggling, like Reebok, when they sign these deals. They want to participate in that upside for these companies." Monday Night Football can still be a winner |

| |||||||||||||||