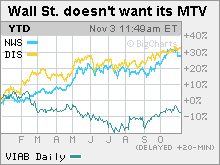

Big media's big comebackInvestors expect News Corp. and Disney to keep chugging along, but wonder if Viacom's new CEO can get the parent of MTV back on track.NEW YORK (CNNMoney.com) -- Most media stocks have enjoyed a revival on Wall Street this year after a disappointing 2005. But whether or not the group finishes the year on a strong note will largely depend on what three industry leaders say in their upcoming earnings releases. News Corp, Viacom and Walt Disney will all announce financial results next week for the quarter that ended in September. For News Corp (Charts)., which owns the Fox TV network and movie studio, and Disney, parent of ABC and the ESPN cable network, times are good. Both companies have healthy TV and movie businesses. News Corp. and Disney (Charts) have also been praised by investors for their Internet strategies. News Corp. owns the popular social networking site MySpace while Disney has made many of its TV shows and movies available on Apple's iTunes music store. As such, shares of both companies have surged about 30 percent this year and both are trading near 52-week highs. It's a different story at Viacom (Charts) though. The company, which owns cable networks MTV and Nickelodeon and the Paramount movie studio, is the industry's laggard. Shares have fallen 7 percent this year. The company's networks have been hit by a slowdown in cable advertising and its movie business is struggling. The widely-hyped "Mission: Impossible III" was a commercial disappointment and that led the company to cut ties with the film's star Tom Cruise back in August. Shortly after that, Viacom ousted its chief executive officer Tom Freston. With all this in mind, investors will be curious to see if Disney and News Corp. can maintain their momentum and whether or not Viacom's new CEO Philippe Dauman has a plan for a turnaround. Investors are also hoping to see results that are a bit better than the so-so earnings releases from two other media giants this past week. Time Warner (Charts), the world's largest media conglomerate, reported third-quarter sales and earnings that were below Wall Street's consensus estimates. But the company reaffirmed its growth outlook for the year. Its cable, Internet and network TV businesses did well but Time Warner's movie studio and magazine publishing business did not. (Time Warner owns CNNMoney.com) CBS (Charts), which was spun-off from Viacom earlier this year, also reported good, but not great, results. Operating profits increased 4 percent thanks largely to strong demand for billboard advertising. But sales from its broadcast TV business were flat and revenue in its radio division fell 6 percent from a year ago. Will News Corp., Viacom and Disney also report mixed results? Here's a closer look at just what Wall Street will be looking for from these companies. News Corp. Analysts expect the company to report fiscal first-quarter sales of $5.9 billion, up 4 percent from a year ago, and earnings of 21 cents a share, an increase of 17 percent. News Corp. will report its results on the afternoon of November 8. News Corp.'s studio business, led by strong box office sales of summer hits "X-Men: The Last Stand" and "The Devil Wears Prada" should be a bright spot for the company. And although ratings for the company's network TV business are off to a sluggish start this fall, this probably won't have a major impact on the company, since News Corp. is expected to benefit from strong ratings at many of its cable networks. In addition, Fox has tended to start slowly and pick up ratings steam once big hits such as "American Idol" and "24" return in January. But investors might be most curious to hear about the growth taking place at its Fox Interactive Media unit, which includes MySpace. News Corp. signed a multi-year advertising deal worth at least $900 million with search leader Google (Charts) in August. "The Google relationship validates the acquisition of MySpace," said David Joyce, an analyst with Miller Tabak + Co. Viacom. This will be the first earnings report under the new leadership of Dauman. The company, which will report third-quarter earnings on the morning of November 9, is expected to report sales of $2.8 billion and earnings of 48 cents a share. Comparable figures for a year ago were not available since last year's figures included results from CBS. The movie studio's troubles could weigh on results but since Hollywood is such a cyclical business, Wall Street may not be too concerned about the ins and outs at Paramount. What investors are more interested in is whether or not ratings for its cable networks and advertising are picking up. Joyce said that Viacom appears to have lost some of its younger viewers to Internet sites like YouTube and other social networking and entertainment sites. Although Viacom's cable networks reported a healthy sales increase of 8 percent and operating profit increase of 12 percent from a year ago in its second quarter, that lagged the growth rates of both Disney's and News Corp's cable networks. Viacom has also been criticized for a perceived slow approach to digital media. Although the company has bought several Web sites in the past year, including online video firms IFILM and Atom Entertainment, all Wall Street seems to care about is the fact that Viacom didn't buy MySpace. But Dauman told investors in September that Viacom expects to make more small online deals. And this week, Viacom's MTV Networks unit announced that it named Mika Salmi, formerly the CEO of Atom Entertainment, as the new head of MTVN's global digital media business. Disney. It's hard to find anything at the company that isn't working. ABC is leading the fall ratings race in the key 18-49 year-old demographic thanks to hits like "Grey's Anatomy," "Desperate Housewives" and "Lost." ESPN has garnered huge ratings for "Monday Night Football." The company's movie studio is responsible for the two biggest blockbusters of the summer, "Pirates of the Caribbean: Dead Man's Chest" and "Cars." And despite some signs of a slowing economy, theme park attendance remains robust. So it should come as no surprise that Disney should have the best quarter of all the major media firms. Analysts expect the House of Mouse to report fiscal fourth-quarter sales of $8.7 billion, up 12 percent from last year, and profits of 33 cents per share, a 43 percent increase.

Miller Tabak's Joyce does not own shares of the companies mentioned and his firm has no banking ties with the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|