NEW YORK (Money Magazine) -- If she thought it would really fix her family's finances, Amy Schuett would make it her New Year's resolution to squeeze every bit of extra spending from the family budget.

But she's already slashed so many little luxuries - the gourmet coffee, the restaurant lunches, the weekly dates with husband Brian - that she's fresh out of ideas.

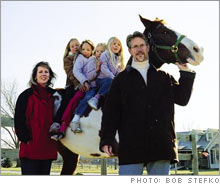

| | The Schuett kids gave up ballet lessons and gymnastics for the pleasure of riding Red, a gift from their grandparents. The kids from left: Ashley, Sabrina, Sage and Nina. |

|

|

|

|

|

Cable TV? Unplugged. Pool membership? Down the drain.

They've even considered giving up their unlisted phone number. At a cost of $3 a month, this move wouldn't save much - even over, say, 150 years - but it shows how desperate the couple feel about easing their financial strain. "We're struggling week to week to get by," says Brian, 42. "Any money that comes in gets chewed up right away."

Digesting that fact becomes harder when you consider that the Schuetts earn a comfortable living, with Amy, 39, pulling in $150,000 a year as a hospital psychiatrist. True, their income did take a big hit last summer when Brian got laid off from his job as a sales rep for a pharmaceutical firm (he'd been making a base salary of $82,000 a year, plus commissions as high as $24,000).

And they do have four daughters to raise, ages four to nine. But still.

The Schuetts don't have any child-care bills (Brian is now a stay-at-home dad). They don't have credit-card debt. They don't splurge on fancy vacations. And they live in a nice but definitely not luxurious home on a three-acre plot in Elkhorn, Neb., just west of Omaha, where the cost of living is, well, livable.

Yet, says Amy, "We live from one paycheck to the next, we're struggling to save and we never seem to have enough money to do anything fun."

It's a statement that an awful lot of Americans can make these days. About two-thirds of families need their next paycheck to meet their living expenses, according to a recent survey by the American Payroll Association.

While many claim to be clueless about where all their money is going, it's often easy enough for an objective observer to figure out. After all, easy credit makes blowing bucks at the mall (or anywhere else) painless - at least until you find yourself mired in high-interest debt.

And once your lifestyle has been lifted, it becomes utterly unthinkable to live without satellite radio, TiVo, iTunes and Netflix. And is any suburban clan complete without a monstrous SUV in the driveway? (It can't fit in the garage.)

If, like the Schuetts, you're determined to stop living for every payday and start saving, these strategies should help.

Automatic savings: Take it off the top

There's only one thing that stands between the average person and the discipline needed to save on a regular basis: human nature. When it comes to money, "we tend to spend as much as we have," says Susan Kaplan, a financial planner in Newton, Mass.

So take self-discipline out of the equation by enrolling in automatic investing plans through your employer and financial services providers; you tell them how much to deduct from your paycheck or checking account, and the money will be shifted every month into investments of your choice without further ado from you. In effect, you make the discipline of saving your money someone else's job.

Set targets for how much you should be saving for various goals through these automatic investing plans, then slowly work your way up to the goal.

Financial planner Bonnie Hughes, for instance, suggests that you aim to have at least 10 percent of your income directed to a 401(k) or similar retirement account (15 percent would be ideal); 4 percent in a savings account or money-market fund designated for emergencies (you can stop once the account is equal to six months' worth of your living expenses); and another $100 a month going into 529 plans for each of your kids.

The important thing, though, is just to get started with a different way of thinking about money: From this day forward, you will treat saving like a bill and make it the first one you pay each month. And you will no doubt find yourself automatically adjusting your spending downward as a result.

Kaplan notes, "If you never have the money at hand, you can't spend it."

Target big expenses

Some cutbacks, of course, will be necessary to accommodate your now lofty savings goals. Most people trying to break the paycheck-to-paycheck habit focus, as the Schuetts have, on the "latte factor" - the little luxuries (like a daily dose of java at Starbucks) that add up over time.

Don't fool yourself. Small economies are just that: small. If you're really serious about getting a handle on spending, you need to identify the big-ticket drains on your cash flow - and there are always one or two - and do what you must to plug those holes.

If you're honest with yourself, you probably already know what you're spending a small fortune on.

Maybe it's extracurriculars for the kids (try adding up the cost of piano lessons and the private math tutor, not to mention sleepaway camp).

Or maybe it's your twiceyearly vacations (winter in the Caribbean? an Alaskan cruise last summer?).

But whether you're genuinely clueless about where your money goes or just don't want to face up to the prospect of giving up or cutting back on something that matters a lot to you, consider avoidance time officially over. Carve out an hour or two to sit down with your spouse to go through your check register and your year-end credit- and debit-card summaries to see what big, discretionary expenses leap out at you. Then talk seriously about what you both can and should do to whittle those bills down.

A closer look at the Schuetts' finances reveals, for example, that a big chunk of their income is eaten up by two rental properties. Brian purchased them thinking they'd generate extra income, but he has yet to find tenants. Even when the properties are finally occupied, the area's softening rental market probably won't allow them to make enough to cover carrying costs.

Meanwhile, the two houses are expected to appreciate only about 3 percent a year - the couple can do better than that with Treasuries (bonds, at least, will never need expensive new wiring).

But the Schuetts haven't had a heart-to-heart about selling the properties yet because Brian has been so keen on making them work. "Our strategy has been to practice 'avoidance,'" says Amy. "But you don't have to be a psychiatrist to see that."

Tackle the beast head on

Once you've identified your budget busters, you have to devise a plan to cut them down to size. Don't try to deal with every aspect of the problem at once - a prospect so overwhelming that you're doomed to fail.

Instead, St. Paul financial consultant Ruth Hayden suggests scheduling weekly meetings for, say, half an hour to talk about just one slice of the financial challenge or task at hand.

During the Schuetts' first meeting, for example, the couple might discuss whether they want to keep or sell their rental properties and, if they decide to stick with landlording, what specific steps they should take to improve their chances of turning a profit.

The second meeting might focus on setting up those automatic savings plans (Amy stopped contributing to her 401(k) when cash got tight; the Schuetts don't have college funds for the girls yet either).

At the third session, they can talk about other systems they can use to help them economize. One simple trick, Hayden suggests, is to earmark cash in separate envelopes at the beginning of the week for expenses like takeout food and dry-cleaning; when the envelope is empty, you can't shell out any more on that item.

"It forces you to plan how you'll spend," says Hayden.

Boost your top line

After you've reined in spending to shore up your bottom line, it's worth thinking about how to fatten the top one. Can you make a reasonable case - either to your current employer or to a prospective poacher - that you're due for a raise?

What about taking on some freelance work to make extra money? Amy Schuett, for instance, says she could agree to an occasional speaking engagement or consulting job. Brian plans to ask two friends who own a home remodeling business if they'd consider giving him some part-time work.

Budget for some fun

"The feeling that you can never get ahead can be demoralizing," says Kaplan. So make sure in your zeal to spend less and save more, you still allow yourself a few expenditures that bring your family real pleasure. You just need to figure out in advance how you'll pay for them.

Last year, for instance, Brian's parents gave the Schuetts a horse named Red for their kids to ride. They think it will cost a few hundred dollars a month to feed and care for the animal, and they're willing to give up ballet lessons and gymnastics classes for the girls to pay for it.

The trade-off is worth it, says Brian, because "the kids so love having a horse."

In fact, Amy has already got a name if they get a second horse: Buttercup. "We'll probably have to wait a while for that," says Brian. "We've got another beast to tame first."

_________________________

5 BIG goals - and how to reach them:

Be a millionaire

Retire early

Launch a business

Own your dream home

Send your kid to Harvard