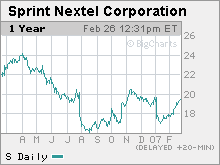

Takeover rumors run at full 'Sprint'Sprint Nextel stock has surged on talk a cable company might buy the struggling wireless carrier. Not so fast.NEW YORK (CNNMoney.com) -- It's been a tumultuous couple of months for Sprint Nextel, and that has led to some speculation that the wireless company could be a takeover target. The integration of the Nextel merger, which was completed in 2005, has not gone as smoothly as investors hoped. And the company is facing intense competition from Verizon Wireless, a joint venture of Verizon (Charts) and Vodafone (Charts), and AT&T's (Charts) Cingular.

Sprint Nextel (Charts) Wednesday reported fourth-quarter sales and profits that were in line with Wall Street forecasts. And while it gained subscribers overall, it said it lost 306,000 so-called postpaid subscribers during the quarter. These subscribers, who pay based on their prior month's usage, tend to be more profitable customers for Sprint than other subscribers. In addition, Sprint Nextel warned in January that its sales for 2007 would be lower than expected. Yet, the stock is up nearly 7 percent in the past two weeks. Patrick Comack, an analyst with Zachary Investment Research, said that buyout rumors are the reason for the stock's increase. Comack said he's heard from hedge fund managers that cable companies Comcast (Charts) and Time Warner Cable, the cable subsidiary of media giant Time Warner (Charts) which will soon begin trading as a separate stock, have been mentioned as potential buyers. (Time Warner also owns CNNMoney.com.) Spokesmen for Comcast, Time Warner Cable and Sprint Nextel said their firms do not discuss market speculation. But Comack and other analysts said that investors should not buy into the takeover hype. For one, both Comcast and Time Warner Cable are partnering with Sprint to offer wireless service to their cable customers. So while takeover rumors aren't completely out of left field, there's probably no compelling need for either company to own wireless networks at this time. In late 2005, Sprint Nextel announced a deal to resell cell phone service to cable customers of Comcast and Time Warner Cable, as well as privately held Cox Communications and Advance/Newhouse Communications. The cable companies and Sprint are in the process of rolling out this service now. "If Comcast or another cable company wants to own wireless spectrum then it makes sense for them to buy Sprint because they are already doing business with Sprint. I guess it's always a possibility. But a deal is not probable at this point," said Jeff Kagan, an independent telecom analyst based in Atlanta. Sprint's troubles with the Nextel merger integration could also keep prospective buyers, particularly Comcast, away in the near term. Shares of Comcast have surged during the past year owing to healthy gains in subscribers and strong fundamentals. A deal for Sprint could jeopardize the goodwill that the company has built on Wall Street. "What are the chances Sprint could be put into play? Frankly, it's a tough deal to make for Comcast. There are a lot of headaches to deal with in the short term. A move like this could hurt their stock price and raise a lot of questions," said Victor Schnee, president of Probe Financial Associates, an independent telecom research firm based in Ironia, N.J. And even though Sprint Nextel's stock has fallen about 20 percent in the past year, Comack argues that shares, which currently trade at about $19.50, are not yet cheap enough to tempt Comcast or Time Warner to make a bid. "Certainly there's a price where a cable company might want to buy them. If the stock goes to $14 maybe they would think about doing it. But it's not going to happen anytime soon," he said. Scott Cleland, founder and president of Precursor, a telecom industry research and consulting firm based in McLean, Va., said that he did not think Sprint was in as much trouble as many on Wall Street think it is. Cleland argued that the merger integration problems are temporary, not permanent. As such, he believes that the takeover speculation is the result of investors who may be growing impatient with the company looking to make a quick buck. "A lot of people like to stir the pot. There's not a lot of downside for them to do that. Some of these takeover rumors are just mischief," he said. Comack and Cleland both added that they found it amusing that the Comcast-Sprint merger rumors continue to pop up every now and then considering that Comcast Chairman and Chief Executive Officer Brian Roberts has gone on the record numerous times to say that he's not interested in buying Sprint. "People just don't listen to Brian Roberts. I guess people assume he's lying when he says he doesn't want to buy Sprint," Comack quipped. Sprint probably would not make a good candidate for a leveraged buyout either, analysts said. Even though private equity investors have expressed a keen interest in the media and telecom sectors, buyout firms typically use debt to finance their deals. And Sprint Nextel already has about $22 billion in debt on its balance sheet. Still, Kagan added that it's not surprising for Sprint takeover rumors to be making the rounds, given that the telecom and cable industries are undergoing such rapid change. To that end, Sprint is not the only company being talked about as a telecom buyout target. Albert Lin, an analyst with American Technology Research, wrote in a report Monday morning that rumors about Verizon making a bid for wireless company Alltel (Charts), which ranks as the fifth-largest carrier behind Cingular, Verizon Wireless, Sprint Nextel and Deutsche Telekom's T-Mobile, have started to resurface. Sprint has also been mentioned in the past as a potential suitor for Alltel. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. Analysts quoted in this story do not own shares of the companies mentioned, and their firms have no investment banking relationships with the companies. |

Sponsors

|