NBC: No Big ComebackThe Peacock Network was strutting earlier this year, but with ratings down once again, some GE investors are growing impatient.NEW YORK (CNNMoney.com) -- General Electric chairman and chief executive officer Jeff Immelt had many great things to say about his company's NBC Universal unit back in January when GE reported its fourth-quarter results. At that time, Immelt and the NBC Peacock had many reasons to be proud. NBC was in a tie for second place with Walt Disney (Charts)-owned ABC in the key 18-49 demographic and was only slightly behind leader CBS (Charts), according to figures from Nielsen Media Research.

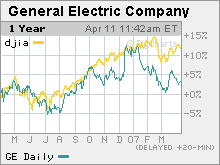

What's more, NBC, thanks to new hit "Heroes" and Sunday Night Football telecasts, finished in a tie for second with CBS (trailing ABC) with 18-49 year-olds during the important November sweeps period. "The turnaround is underway. You look at prime-time, we're making real progress," Immelt said during a conference call with analysts on January 19. But a lot has changed on the TV landscape since then, and Immelt may find it difficult to be as positive about NBC when GE reports its first-quarter earnings on April 13. The football season is over, which means NBC has been far less competitive on Sunday nights. And "Heroes" has been on an extended break. The last new episode appeared on March 5 and the next one won't air until April 23. Plus, a little show on News Corp.'s (Charts) Fox called "American Idol" has returned. And ABC has brought back "Dancing with the Stars." Plus NBC didn't have the Winter Olympics this year to help boost ratings during February sweeps. So now NBC finds itself back in familiar territory: fourth place among the major networks with both total viewers and 18-49 year-olds. In addition, ratings at NBC are lower than last year. The results from NBC's movie business haven't been too great either. According to figures from movie research site Box Office Mojo, Universal Studios releases account for about 8.5 percent of the total U.S. box office dollars so far this year, down slightly from market share of 8.9 percent in 2006. NBC Universal's biggest release so far in 2007 is the romantic comedy "Because I Said So," which generated an underwhelming $42.7 million at the box office. The one bright spot has been with NBC Universal's cable channels. USA is currently the top-rated cable network during prime-time. The NBC unit is a small, but relatively important one for GE. The division accounted for 10 percent of GE's sales in 2006 and 13 percent of operating profits. But investors have been hoping that NBC Universal could turn around and no longer be a drag on earnings. Although revenues at NBC Universal increased 10 percent last year, profits fell 6 percent. One GE investor said he does not believe Wall Street has high hopes for NBC Universal this quarter. "I don't think there are a lot of expectations with the broadcasting unit. Last quarter was okay and nobody is really looking for any surprises," said John Snyder, manager of the John Hancock Sovereign Investors fund, which owns about 1 million shares of GE. Like other media companies, NBC Universal has been faced with pressures to increase its presence online to combat increased competition from "new media." To that end, NBC Universal acquired iVillage, an online community for women, last year, with the intention of merging TV and Internet content. And last month, NBC announced that it was teaming up with News Corp. to launch an online video service featuring NBC and Fox content that could compete with the likes of Google's (Charts) YouTube service. NBC also said it intends to focus more on international markets, with plans to launch 20 channels across Europe, Asia and Latin America over the next few years. "There is a lot of potential with digital initiatives and international growth. There are a lot of opportunities there," said James Denney, manager of the Electric City Value fund, which owns GE. Still, some investors are anxious to see tangible results of the company's turnaround strategy. GE, which promoted TV chief Jeff Zucker to president and CEO of all of NBC Universal in February, has also taken steps to boost profits at the unit. Last year, NBC said that it will rely more on unscripted reality shows for this fall's TV season and also announced layoffs and cost cuts at the division's news operations and movie studio. Immelt promised investors in January that profits at NBC Universal in the first quarter would be in a range of flat to up 5 percent from a year ago and that revenues would be unchanged compared to last year after excluding the impact of the Olympics in the first quarter of 2006. "You look at GE and there are a lot of good things that are going on with the company, but NBC is one of the weakest divisions. We would love to see GE put NBC up for sale," said Mike Gandrud, a senior analyst with Johnson Asset Management, an institutional investment firm that owns GE in the JohnsonFamily Large Cap Value fund. Immelt refuted speculation in February that GE was looking to sell NBC Universal. But Snyder also thinks GE might face more pressure in the coming months to dump NBC if the division does not begin to post higher profits since that could keep GE's stock, which has traded in a range of about $32 to $38 for the past year, stuck in the mid $30s for the foreseeable future. The big problem, though, is that it might be tough for GE to get a good value for NBC Universal now since the flagship broadcast network remains in fourth place. So Snyder doubts Immelt would want to unload NBC until there are more signs of improvement. "If the stock stays around $35 for another six months, Immelt may think about a sale of NBC but you probably wouldn't want to do it now. You'd want to do it when it's in better shape." |

Sponsors

|