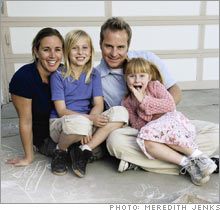

Good job, big plans - no savingsYou've got a good job, a fine family and big dreams. Isn't it time you had some money in the bank, too?(Money Magazine) -- Darek Dohy and Jenn Farber have ambitious plans. After dating for two years, they want to marry, move from Norwalk, Calif., to Seattle, buy a home and set aside money for Dohy's two daughters, ages six and eight. But their big plans have a big hitch: Dohy and Farber have almost no savings - between the two of them, only a few hundred dollars in the bank and a few thousand in retirement accounts.

CDs & Money Market

They've also got around $40,000 in credit card debt, with only closets full of "stuff" and memories of dinners out to account for it. "Up until now my life's really been about recreation," says Dohy. "My goal is to have it together by age 40." The catch: That's only two years away. The two don't lack for money. Farber and Dohy earn a combined six-figure income in medical-supply sales. It's their behavior that's out of whack. "My instinct is if I want something I'll just go and get it," says Farber, who realized they were in trouble last winter. "Christmas came and I felt like I was at the bottom of the Grand Canyon," she says. "I had so many bills and nothing to show for it." Let's face it: America's buy-now, pay-later society doesn't exactly encourage saving. There are infinitely more mail promotions for credit cards than for IRAs and 529 plans. And saving when you're just getting started isn't easy. "When you're 24 years old, you're focused on more immediate goals: getting that special job and having the right apartment, paying the student loans," says Loretta Abrams, vice president of consumer affairs at banking giant HSBC North America (Charts). But more Americans are extending that postgrad period. "People are less willing to defer gratification. They want to live like Mom and Dad," says Abrams. "They get overextended early on." Skimpy savings are increasingly common among those in their middle years. In a 2007 survey by the Employee Benefit Research Institute, a nonpartisan research organization, about a half of workers ages 35 to 44 said they had salted away less than $25,000 for retirement. Unfortunately, those early-adult years offer the richest potential for growth: Invest $10,000 at age 30, and by retirement it will grow to more than $100,000, assuming a 7 percent annual rate of return. Wait 10 years and you'll have only half as much. To amass what you need means jumping off the spending rail and scrambling onto the savings track. Delaying the move compounds only your problems and debts, not your interest. You'll be in even worse shape 10 years from now if you don't change your ways. And once you begin saving, you'll find that you can easily adapt to living on less. Here's how to get started: Make saving job No. 1 If you're an undersaver, you probably look at savings as leftovers. You figure that you'll set aside whatever you have after you've paid all the bills. As your Uncle Jack, your home economics teacher or any financial planner would tell you, such thinking is just plain wrong. Usually nothing's left over. Says Michael Furois, a financial planner in Phoenix: "There's always something else to spend it on." To succeed you have to turn your philosophy inside out and put money aside before you pay any other bill. The rule - pay yourself first - is as old-fashioned as any around, but following it works. Without that extra money to spend, a budget falls in line. How much should you be saving? The conventional wisdom says 10 percent of your pretax earnings, but some now contend that you'll need more. If your budget is tight, try for 5 percent or 10 percent to start. You don't have to rely on willpower to get the job done. You can ask your employer, bank or mutual fund company to extract money automatically - and periodically - from your paycheck or your checking account and deposit it in a 401(k), an investment or an interest-bearing account, depending on your needs. Put it in the right places Your first savings should go to an emergency fund, three to six months' worth of household expenses that can be used to get you through a job loss, an uncovered medical expense or some other unforeseen event. The money should go into a bank savings account or money-market mutual fund where you can get your hands on the cash quickly. Retirement should be the next priority. If your employer matches contributions to a 401(k) plan, contribute enough to get every dime your employer matches. Dohy puts 2 percent of his pay in his 401(k), enough to get his full match, but if he added just one percentage point, he would have an additional $71,000 at retirement. (If your employer doesn't offer a 401[k], set up an IRA.) Other long-term goals should be next (for example, college funds), and then the fun stuff (say, a trip to Europe or a new kitchen). Give it a boost Getting your savings up to a respectable amount can seem like an insurmountable feat, especially when you're setting aside small amounts each month. So vow to ramp them up with portions of any windfalls that come your way, such as annual bonuses or a tax refund. If you receive a raise or realize a large savings by, say, finally outgrowing your full-time babysitter, add those amounts (or a portion) to your regular 401(k) contribution. Savers need to take concrete steps to achieve goals. It's not just "we need to save for the kids' college tuitions" but "we need to set up 529 plans for the kids; here's what we have to do to make that happen." Make a list of all the steps and give yourself deadlines. Farber is on her way. She recently transferred her credit card balance to a low-rate card, committed herself to pay between $350 and $500 each month on the debt and put a hold on shopping. "That isn't going to be a part of my life until I get a handle on this," she says. Win in real estate now Debt reduction planner 25 rules to grow rich by Are you heavily in debt? Need help getting out? Paula Zahn Now wants to tell your story. Send e-mails to debt@cnn.com. |

|