To retire early, you must get this move right

You're not ready to go until you've lined up health coverage. This six-step plan can help.

|

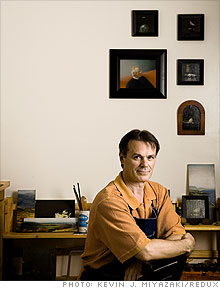

| Paul Weber would like to trade his office for his art studio. The challenge: finding health insurance. |

|

| Paul Weber with his girlfriend, Nadia. |

(Money Magazine) -- Paul Weber has nearly every aspect of his retirement in place. He knows when it will start: The 56-year-old, who earns some $103,000 a year doing graphic design for investment research firm Morningstar, plans to empty his desk by year's end.

He knows where he'll live: with his girlfriend Nadia in their Fox Lake, Ill. home. He knows how he'll finance it: with the $900,000 he's saved. And he knows what he'll be doing: After years of squeezing in his passion for oil painting during odd hours, Weber imagines spending his days in the studio. There's just one part of this picture-perfect retirement that Weber hasn't figured out yet: what he'll do for health insurance.

Retirement will mean the end of Weber's employer-provided health coverage. He can stay on his company's plan for 18 months by paying the full premium, thanks to the federal law known as COBRA. That would take him only to age 58, far short of when he qualifies for Medicare at age 65.

He has thought about braving that gap without insurance to avoid what he expects will be high premiums. But he recognizes that a single medical crisis - cancer, for example - could put his savings at risk. "Something like that could wipe me out," he says.

If you're dreaming of early retirement - or finding yourself forced into it - you'll likely face a similar dilemma. Two decades ago, 66% of large employers offered retiree health benefits, according to the Kaiser Family Foundation. Now only 33% do. And as Weber suspects, getting decent coverage on your own - if you can - is a pricey proposition.

Families headed by people ages 60 to 64 pay an average of $9,201 a year for a private policy, according to a health insurance trade association. Covering your deductible, co-pays and other out-of-pocket expenses could add another $6,000 a year. No wonder some young retirees resort to working at Home Depot or other companies that offer health benefits to part-time workers.

Finding affordable retiree health insurance is intimidating, no question. But it's usually not impossible, says Carolyn McClanahan, a Jacksonville financial planner and medical doctor - especially if you start your planning early.

Do a reality check. Before you get too carried away with an early-retirement dream, you need a realistic idea of whether you can buy insurance on the open market and, if so, whether you can afford it.

Unfortunately, many conditions render you virtually uninsurable in most states, Type 1 diabetes, heart disease and recent cancer among them. Even high blood pressure and obesity can eliminate your chances of buying a policy. Just as bad, you might be able to get only coverage that excludes a particular problem and its complications. So if high blood pressure were on that list, for example, you'd get no help were you to suffer a stroke.

Long before you plan your good-bye party, talk to an independent insurance agent (you'll find a directory at the National Association of Health Underwriters site at nahu.org). Armed with underwriting guidelines from different insurers, he can give you an unofficial appraisal of your odds, gratis. (Don't fret yet. If you can't get insurance this way, you may still qualify for coverage; see "Look for a last resort.").

Also ask for an estimate of your premiums. Then do the math. Assume these will continue to grow at their recent average of nearly three times the rate of inflation, or 10% annually. Add up what you'll pay through age 65. If that comes to $100,000, you may need to save that much more to afford early retirement.

Weber feels pretty healthy, though he recalls that his cholesterol level was a high risk 250 last he checked. If that's his only chronic condition, he might see premiums close to $300 a month, says John Garven, president of the Illinois State Association of Health Underwriters. But if Weber is not in as good shape as he thinks, he could pay as much as $800 monthly.

Get in better shape. The healthier you are, the easier your insurance search will be and the lower your premiums. So it's worth remedying whatever problems you can, says McClanahan. A few years before retiring, get a physical to see if key measurements - like weight, blood pressure and cholesterol - are where they should be. If not, you may be able to improve these and other conditions with medication, exercise or a change in diet. Aim for better health at least a year before you apply for insurance. As for Weber, McClanahan suggests he get to a doctor soon to gauge his health and start fixing any problems.

Probe the paperwork. Even if you're in the best of health, your medical records may paint a less flattering portrait due to errors or omissions. So when you schedule your checkup, ask your doctor to set aside time to review your medical history with you for accuracy.

Also, if you've applied for individual life, health, disability or long-term-care insurance within the past seven years, the industry may already have a file on you. You can get a free copy of what's in yours from the MIB Group (mib.com, under Consumers), an insurance industry clearinghouse. Quickly correct any errors.

Stay with the company. Firms with 20 or more employees must give you the option of staying on your insurance plan for up to 18 months. It's guaranteed coverage, but it isn't cheap. Your premium is roughly what you've been paying plus what your employer's been kicking in. (Weber, a single guy, will cough up $370 a month.)

If nothing else, COBRA buys you time - without risky coverage gaps - before you go into the private market. And if you can't get insurance because of health problems, exhausting COBRA makes you what's known as HIPAA-eligible, guaranteeing certain backup coverage (see last step).

Start the search. Launch your hunt for an individual policy a few months before you leave your job or before COBRA expires (once offered a policy, you usually have to start it within a month). You may want to begin your search at a site like EHealthInsurance.com, but keep in mind that those rates apply to the healthiest applicants. That's why an agent can be helpful in finding the best insurer and deal for your circumstances.

To keep your premiums affordable, your best bet may be a high-deductible insurance plan coupled with a health savings account (HSA), if you qualify. While you'll be on the hook for, say, the first $5,000 in expenses annually, you're protected from big-ticket disasters.

An Aetna plan from AARP (aarphealthcare.com) recently quoted $246 a month for a healthy 56-year-old male in Weber's zip code. You then pay for out-of-pocket costs with money from your HSA, which doubles as a tax-deferred savings plan. HSA contributions are tax deductible - the 2009 limit is $3,000 for an individual, $5,950 for a couple; plus another $1,000 if you're 55 or over. Funds grow tax-free; any nonmedical withdrawals after 65 are taxed as ordinary income.

Look for a last resort. If you can't get individual coverage, you have options, though they're not ideal. By law, states must make last-resort insurance available if you're HIPAA-eligible. But these plans can be limited and costly.

Another tack: Some states mandate guaranteed group plans for businesses with even one employee, which may make sense if you'll do any consulting work. For a national overview of your options, go to statehealthfacts.org and click on Managed Care & Health Insurance.

Finally, if you're up for adventure and can bear cold winters, you could move to one of the five states - Maine, Massachusetts, New Jersey, New York and Vermont - that forbid insurers from rejecting applicants for medical reasons. You'll pay for the privilege, however: Monthly individual HMO premiums in Albany, N.Y., for example, run from $666 to $1,333.

Weber, meanwhile, is intrigued by the high-deductible plan linked to an HSA. "It sounds like an attractive option," he says. Gently reminded by McClanahan that he may need to take better care of himself to qualify, Weber says that he'll get his cholesterol tested at an upcoming company health screening and see his doctor soon. He's willing to put in the effort to make his retirement a masterpiece.

Do you (and your spouse) make more than $170,000 annually and worry about tax-efficient retirement planning? If so, send your name, age, occupation, income and questions, along with a recent photo, to makeover@moneymail.com. We will be providing advice to a family in this situation in an upcoming article - and it could be you! ![]()