Stocks drop ahead of Senate vote

Investors step back after the previous session's big rally.

NEW YORK (CNNMoney.com) -- Stocks slipped Wednesday morning as investors took a step back from the previous session's rally and geared up for the Senate vote later on a tweaked version of the $700 billion bailout package.

The Dow Jones industrial average (INDU), the Standard & Poor's 500 (SPX) index and the Nasdaq composite (COMP) all dropped in the early going.

This follows a tremendous Tuesday on Wall Street, which saw the Dow Jones industrial average jump 485 points, or 4.7%, on hopes for a new bailout package.

On Monday, the Dow plunged 777 points, its worst point drop ever, after the House rejected the bailout bill.

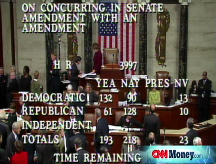

The Senate version of the bill includes new provisions, such as raising the Federal Deposit Insurance Corp. cap protecting deposits to $250,000 from $100,000. The provisions will be added to an existing revenue bill that the House also rejected Monday, according to Democratic leadership aides.

"Everybody's waiting around for the vote from the Senate," said Peter Cardillo, an analyst with Avalon Partners. "It looks like we're going to get a bailout plan. It would be devastating at the point if we didn't."

Economy: As another sign of the economic crisis, the Mortgage Bankers Association's report showed a 23% plunge in mortgage applications in the week ended Sept. 26.

Automatic Data Processing released its monthly employment report, showing a decline of 8,000 private sector jobs in September, from the prior month. In August, the economy lost 37,000 jobs, ADP said.

At 10 a.m. ET, the Commerce Department will release its August measurement of construction spending. Economists surveyed by Briefing.com project a decline of 0.4%, compared to a steeper decline of 0.6% the prior month.

Also at 10 a.m., the Institute for Supply Management - a purchasing managers' group - will release its September index of manufacturing activity. Economists surveyed by Briefing.com project a reading of 50.1, just above the 50 mark that denotes economic expansion and the 49.9 reading in August.

At 10:35 a.m. ET, the Energy Information Administration releases weekly inventory data. Analysts surveyed by Platts expect U.S. crude stocks to range between a 1.5 million barrel increase and a 1.5 million barrel decrease in the week ended Sept. 26.

Markets: The Nikkei closed higher, while European markets were mostly higher. The dollar edged up versus the euro, the British pound and the yen. Oil prices dipped, falling $1.83 to $98.81 a barrel. ![]()