Stimulus: What's in it for small biz?

Emergency bridge loans and reduced fees for SBA-backed loans are some of the stimulus bill's steps to help small businesses survive the recession.

NEW YORK (CNNMoney.com) -- The number of small business loans banks issue has cratered since the recession took root last year. Rebuilding that number is the focus of the small business provisions in the economic recovery bill that President Obama signed into law on Tuesday.

The bill authorizes the Small Business Administration to temporarily eliminate or reduce fees for participation in its flagship loan-guarantee programs, which insure banks against default by small business borrowers. The stimulus bill also increases to 90% the percentage of qualifying loans that the SBA can guarantee.

For companies in need of quick relief, the bill offers a "small business stabilization financing," which gives them money to pay off existing loans. Under the program, the SBA can issue or back loans of up to $35,000; businesses can then use the money to make up to six months of payments on previous loans. Interest on stabilization loans will be fully subsidized, and the loans won't have any payments due for the first year. Borrowers must repay them within five years. Details of how and when the program will be implemented will be left to the SBA, which is currently waiting for Obama's nominee to head the agency, Karen Gordon Mills, to be confirm.

The SBA has a limited window of time and cash to fund these emergency measures. Congress allocated $630 million to fund loan subsidies and modifications, and authorized them to continue through September 2010. If the cash starts to run out, borrowers will have priority over lenders - and small banks will have priority over larger ones - for receiving fee discounts and waivers.

Other stimulus measures aimed at small businesses include:

Unfreezing the loan market: Banks say one major reason they've cut down on SBA lending is their inability to resell those loans to investors. Since October, that secondary market has been essentially dead. The recovery bill allows the SBA to guarantee up to $3 billion in debt in those loan bundles, a move officials hope will make the bundles more attractive to investors and encourage banks to expand their SBA lending. The SBA will charge fees for its guarantees to keep the program cost-free to taxpayers.

Loss accounting: Companies with operating losses can currently use those losses to reduce their tax bills for two years prior to the loss and 20 subsequent years after the loss. For the 2008 tax year, the bill extends the carryback provision to five years, a move that will help some businesses cut the tax bill they'll need to pay by April. The option is available to companies with gross receipts of $15 million or less.

Equipment expensing: The government wants you to buy new equipment. Last year's stimulus bill expanded "section 179" expensing, a provision that lets businesses deduct as an expense the costs of some property purchases such as vehicles, machinery and computers. Normally, a business can write off up to $125,000 in spending on such goods. Last year, Congress temporarily increased that amount to $250,000 for expenditures in 2008. The new stimulus extends that higher limit through 2009. The provision is aimed at small companies: The deduction is phased out for businesses that spend more than $800,000 on capital expenditures for the year.

Hiring incentives: If you hire an unemployed military vet or a high-school dropout, you could get a $2,400 per worker credit on your taxes. The existing Work Opportunity Tax Credit lets businesses claim a tax credit for 40% of the first $6,000 in wages paid to a worker who falls into a qualifying "target group" of traditionally disadvantaged workers. The recovery bill adds two new classes of qualifying workers: veterans who left the military within the past five years and collected unemployment for at least four weeks before being hired, and "disconnected youths." A worker counts as "disconnected" if they're between the ages of 16 and 25 and haven't attended school or had regular employment in the past six months.

Capital gains: Individuals who invest in small businesses over the next few years will get a nice break on their capital-gains taxes. If you buy stock in a small business, hold it for at least five years, and then sell it, current tax law allows you to exclude 50% of your gains (within certain limits). The stimulus bill increases that exclusion to 75% - but only for stock issued after the bill is enacted.

Microloans: One of the SBA's lesser-known loan programs focuses on microloans of up to $35,000. The program requires applicants to apply through nonprofit community organizations. Those institutions vet applicants and make the loans, but the SBA makes money available to the community groups to finance their lending. Last year, the SBA funded loans totaling $20.2 million through the microloan program. The stimulus bill allocates an additional $6 million to directly fund microloans this year, plus $24 million for marketing and management of the microloan program.

The compromise bill approved by Congress lost a few provisions contained in earlier versions passed separately by the House and Senate.

Gone is a House proposal for a new authority within the SBA to make direct loans to small businesses repeatedly turned down by the banks. Also struck out was a Senate proposal to increase the size of the maximum loan available through the SBA's 7(a) guarantee program, which currently caps loans at $2 million.

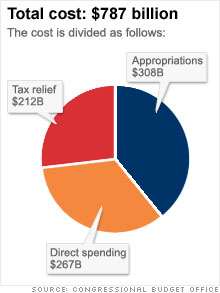

Direct spending on small businesses initiatives totals $730 million, but Congressional leaders hope that cash will have an outsize impact by unlocking billions in new spending by banks, investors and business owners.

"Taken together, these initiatives are expected to result in nearly $21 billion in new investment and lending for small businesses," said Rep. Nydia Vel�zquez, D-N.Y., the chairwoman of the House Committee on Small Business. "America's small businesses have led our nation out of previous economic downturns and, given the right tools, they can do so again."

Senate Small Business and Entrepreneurship Committee Chair Mary Landrieu, D-La., praised the package as a good first step toward helping small companies access capital and create jobs, but acknowledged that more work remains ahead. Her committee's priorities include increasing funding to the SBA, strengthening the SBA's disaster loan program, and pushing Obama to elevate the SBA's administrator to a Cabinet-level position. ![]()

Restarting the frozen loans market

The view from Maine Street

6 companies born during downturns

Massive job losses: What's left to cut?

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More