Ruth Madoff sued for $45 million

Court-appointed trustee claims Ruth Madoff has $44.8 million and wants her to turn it over for victims. Her lawyer says suit is 'perplexing.'

|

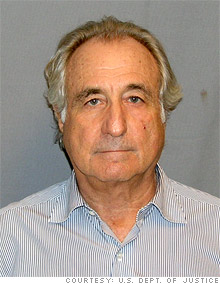

| Ponzi convict Bernard Madoff, shown here in his MCC mugshot, is serving 150 years. |

NEW YORK (CNNMoney.com) -- Ruth Madoff, wife of imprisoned Ponzi schemer Bernard Madoff, was sued Wednesday by a court-appointed trustee seeking $45 million in funds to compensate victims.

Last month, federal authorities seized the Madoffs' assets but left Ruth Madoff with $2.5 million -- an amount they could not tie to her husband's massive and long-running Ponzi scheme.

But Irving Pickard, the trustee appointed by U.S. Bankruptcy Court in New York, said that Ruth received $44.8 million in "fraudulent" transfers during the six years leading up to the bankruptcy of her husband's investment firm.

"While Madoff's crimes have left many investors impoverished and some charities decimated, Mrs. Madoff remains a person of substantial means," Pickard wrote in the suit. "The inequity between Mrs. Madoff's continuing financial advantages and the economic distress of Madoff's customers compels the trustee to bring this action."

Ruth Madoff's lawyer described the trustee's lawsuit as "perplexing" and unwarranted.

"[T]he trustee is alleging that she should have to give up her remaining money even if she was completely unaware of her husband's crimes," Peter Chavkin of the firm Mintz Levin said in a statement.

Ruth Madoff has not been charged with a crime, unlike her husband of 49 years, who pleaded guilty on March 12 to 11 federal counts for running a decades-long Ponzi scheme that is believed to have run into the billions of dollars.

In fact, Bernard Madoff has been forced to forfeit property to comply with a $170 billion legal judgment. That figure is based on the amount of money the government says was handled by his firm since its founding in the 1960s.

Bernard Madoff, 71, was sentenced to 150 years on June 29. He is incarcerated at the medium security Federal Correctional Institution Butner in North Carolina, north of Raleigh. His release date is Nov. 14, 2139.

Judge Denny Chin of the U.S. District Court in Manhattan said he based the maximum sentence on the damage that Madoff inflicted on his thousands of victims. As in a classic Ponzi scheme, Madoff accepted funds from his investors and stole instead of investing it. He used fresh funds to make payments to other investors. ![]()