Dollar mixed against rivals

The greenback falls against the yen and pound, but holds up versus the euro, after Wall Street seesaws.

NEW YORK (CNNMoney.com) -- The dollar was mixed against its main trading partners Wednesday as a retreat on Wall Street boosted some demand for the greenback as a safe haven.

Investors took a breath from a two-day advance in the stock market as commodity prices edged higher.

The dollar rose .29% against the euro to $1.4680. The greenback fell .17% against the pound to $1.5949 and .21% against the yen to ¥88.6360.

"There's been a lot of pressure built against the dollar in the last few days and it is finally unwinding," said John Kicklighter, currency strategist at DailyFX.com, noting widespread talk about the dollar being unseated as the currency for trading oil.

"But still, [the dollar] didn't really establish any solid strength," he said.

Kicklighter said the dollar will continue to move in the opposite direction of stocks and expects equities "to make a significant retracement."

"There's been a lot of optimism behind capital gains, but if that turns around it will bolster the dollar," he said.

Increasing the amount of consumer credit outstanding could also boost the dollar, said Kicklighter. The Federal Reserve said consumer credit dipped for a seventh straight month in August in a report released Wednesday.

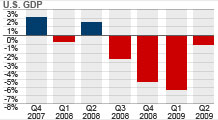

During the recession, banks have been restricting the amount of credit they extend and consumers have curbed spending, reducing the amount of consumer credit.

"Increasing consumer credit is vital to a true economic recovery," Kicklighter said, adding that an improving economy would trigger appreciation for the dollar. ![]()