Dubai shares plummet 7%

Market tumbles amid ongoing concerns about the emirate's credit problems. Asian shares recover while Europe sinks.

NEW YORK (CNNMoney.com) -- Stocks in Dubai plunged more than 7% Monday, the first day of trading after the Persian Gulf state's debt problems roiled financial markets around the world.

The index for the Dubai Financial Market, the emirate's main stock exchange, ended the day down 7.3% at 1,940.36. It was the first day of trading since Dubai World, the state-run investment vehicle, requested a six-month delay on payments it owes on a roughly $60 billion debt load.

The Wednesday announcement raised fears about the health of the global financial system and rattled investors worldwide. But those concerns were eased somewhat Sunday after the United Arab Emirates stepped in to offer Dubai some support.

The UAE, a federation of seven emirates including Dubai, said it will create an emergency liquidity facility to help prevent the city-state from defaulting on its debts.

Fellow emirate Abu Dhabi also announced plans to selectively aid Dubai banks.

The moves helped revive confidence in Asia, where stock prices rallied after a sharp selloff last week. Japan's Nikkei rose nearly 3% while the Heng Seng in Hong Kong advanced 3.2%.

Major indexes in Europe, however, remained under pressure. Shares in London, Paris and Frankfurt all ended the day at least 1% lower.

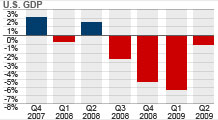

U.S. stocks slipped in choppy trading as investors largely looked past concerns about Dubai World to focus on a weaker dollar, a better-than-expected reading on manufacturing and the start of the holiday shopping period.

Dubai borrowed billions over the last several years to fuel an extravagant construction boom. But the emirate was hit hard by the credit crunch and investors are concerned about the possible fallout if Dubai World is forced to liquidate assets at fire-sale prices.

While many analysts say the pain would be felt mostly by European banks, there are some who say U.S. banks are also at risk. (Dubai's threat to U.S. banks)

"This week I will be keeping my eyes peeled to see which, if any, banks have significant exposure," said Dan Cook, senior market analyst at IG Markets.

"I find it difficult to believe that with the amount of money being pumped into and the returns coming out of Dubai over the last several years, that some of the major players are not exposed more than they have initially let on," Cook wrote in a research report.

The Dubai debt crisis also made investors nervous about potential threats to the budding economic recovery. Stocks around the world have generally been rising since March as economic conditions have improved, but many investors say the market may have moved ahead of economic reality. ![]()