Search News

NEW YORK (CNNMoney) -- The Los Angeles Dodgers filed for bankruptcy court protection early Monday, less than a week after Major League Baseball blocked the team from signing a new television deal to provide it with the cash it needed to meet the team's payroll.

The bankruptcy filing also comes in the wake of a bitter divorce battle between owners Frank and Jamie McCourt, who finally reached a settlement earlier this month.

But Frank McCourt still needed approval of a new $3 billion television deal with Fox Sports, and Commissioner Bud Selig blocked the deal with the News Corp. (NWS) unit last week, who said he couldn't approve a deal which he said was "structured to facilitate the further diversion of Dodgers assets for the personal needs of Mr. McCourt."

Selig had already appointed a monitor to oversee the club's business operations. McCourt had vowed to fight any effort to force him to sell the team, but that effort may now be nearing an end with Monday's filing.

McCourt has complained bitterly about not being able to get approval of the 17-year television deal, which he said was critical to the team meeting its liquidity needs this year.

McCourt issued a statement Monday charging that Selig had "turned his back on the Dodgers, treated us differently, and forced us to the point we find ourselves in today."

"I simply cannot allow the Commissioner to knowingly and intentionally be in a position to expose the Dodgers to financial risk any longer," he continued.

However, Selig shot back in a statement of his own.

Selig said Major League Baseball's goal has been "to ensure that the Dodgers are being operated properly now and will be guided appropriately in the future for their millions of fans." He added that the bankruptcy filing "does nothing but inflict further harm to this historic franchise."

With the filing, the Dodgers were able to arrange for $150 million in debtor-in-possession (DIP) financing to fund operations during the reorganization.

Lenders who are unwilling to loan money to troubled companies before bankruptcy filings are sometimes willing to make DIP loans because they are in a preferred position to be repaid.

The filing is under Chapter 11 of the bankruptcy code, meaning the team will continue to operate during the reorganization. But a sale of the team out of bankruptcy is likely, according to experts.

"The handwriting seems to be on the wall here," said Scott Rosner, a professor of sports business at The Wharton School of the University of Pennsylvania. "I see this heading towards litigation, and precedent is certainly not on McCourt's side."

David Carter, executive director of the Sports Business Institute at the University of Southern California, said that McCourt has lost all support within both Major League Baseball and the Southern California business community. He said the bankruptcy filing is a desperation play.

"I don't think you file bankruptcy unless you're running out of cards to play," he said. "Major League Baseball seems to be doing whatever it can to cut off his financial lifelines. Maybe in McCourt's eyes, this buys him enough time to turn things around. But it's the clearly bottom of the 9th inning in terms of his ownership."

The Dodgers said that the team will operate within their existing budget to sign and acquire amateur, international and professional players, and that ticket prices will remain the same and purchased tickets will continue to be honored.

"The Chapter 11 process provides the path on which to position the Los Angeles Dodgers for long-term success," McCourt said.

Last year the Texas Rangers were sold out of bankruptcy, but that did not prevent the team from reaching the World Series for the first time in franchise history.

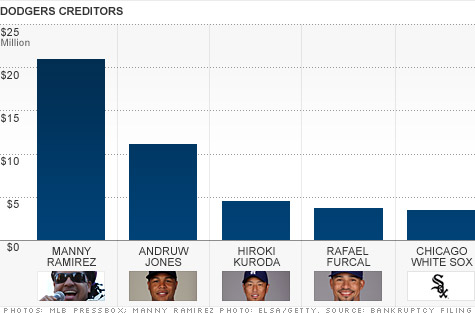

The bankruptcy filing lists numerous Dodgers players, past and present, among its largest creditors, with former player Manny Ramirez the largest creditor, owed almost $21 million.

Players are likely to be paid in full, though, as they have protections under in the collective bargaining agreement between their union and Major League Baseball. ![]()