Search News

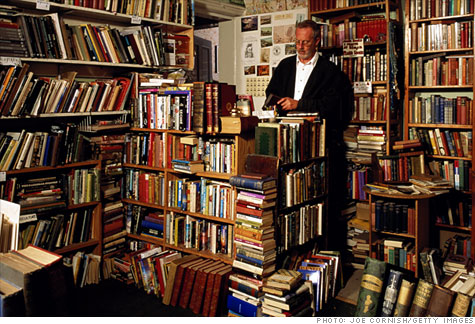

Dusty shelves and cranky clerks could see new life with the loss of one of their biggest rivals.

FORTUNE -- After the news of Borders Group's plan to close the chapter on all its locations, the bookselling industry needs a good story -- and here's one with a twist. Independent bookstores, the very group whose demise was predicted by the rise of the big chains, could fill some of the gap.

After Borders filed for bankruptcy protection in February, it hoped prospective buyer Najafi Companies would keep about two thirds of its 600 stores open. But when the deal fell through last week, Borders opted to liquidate for a loss of 10,700 jobs.

Such a blow to the industry was not a surprise. "We felt it coming for a long time," says David Young, CEO of publisher Hachette Book Group. "But it's a tremendous disappointment that [Borders] finally failed." The loss of so many jobs is felt across the industry, from publishing to the independents for whom Borders was a rival. While the chain drove out many indies with its big-box stores, its employees were often well-liked colleagues and fellow booklovers.

The big question will be how many of Borders' locations can be spared in the liquidation. A recent deal for Birmingham, Ala.-based chain Books-A-Million (BAM) to buy 35 Borders stores fell through, but industry insiders expect Barnes and Noble (BKS, Fortune 500) to fill its own target list. Airport stores are also valuable for their location and might get snatched up.

All told, there are about 400 superstores and small-format Waldenbooks to fill. Replacing Borders with other book retailers would provide the easiest transition, according to Andy Graiser, co-president of DJM Realty LLC, which has the task of auctioning off all of the company's locations.

Do independent bookstores have the muscle and the numbers to fill the void? Several shops in New England have already taken over local Waldenbooks. Oren Teicher, CEO of the American Booksellers Association, is confident that Borders' demise leaves the door open for new stores to open and others to expand. But he's cautious about whether it would make sense for small booksellers to move into Borders' large retail space. College bookstores might make a better fit: In Fairfield, Connecticut, Fairfield University plans to open its new shop in a former Borders downtown.

But for now an indie bookstore renaissance is just speculation. For the most part, independent bookseller trade groups across the nation report they have not encountered small stores moving into Borders locations in their regions.

The problem for independents, Teicher and Graiser agree, is capital. Small booksellers generally lack the funds to buy locations outright. As lease-holders, they will have to mollify landlords in an industry in which Teicher notes the margins are modest. He suggests creative leasing arrangements and close cooperation as a way to make bookstores work better for both parties.

Such creativity might work better for independents to move into locations close to, but not exactly on, Borders' old turf. According to a report by Verso Advertising, over half the 200 Border superstores that closed in February lie more than five miles away from the closest indie bookstore. The gap provides an opportunity for new independent stores to serve the old area in a smaller shop. As for the actual Borders locations, they are more likely to be filled by major retail chains in sectors such as sporting goods or specialty supermarkets, Graiser says.

But even if a small independent bookstore is able to replace every single Borders that closed, the industry cannot ignore the volume loss that comes from the demise of the nation's number-two book chain. Hachette Books' Young says the growth of bookselling survivors will be lucky to account for half the sales that came from Borders. "I'd be surprised, I'd be thrilled, if it gets that high," he says. "That's the high water mark."

Yet as publishers tighten their belts, independent bookstores appear ready to recoup as much of the lost market as they can. According to the ABA, its membership has increased in the past year, while more and more indie sellers -- almost 300 to date -- now offer e-books through a partnership with Google (GOOG, Fortune 500). Amazon (AMZN, Fortune 500) and its marketplace of used-book sellers aren't going away either. For now, expect more independent stores to pick up a bit of the slack -- hopefully staffed by some of the thousands of workers left adrift by Border's sinking ship. ![]()