Search News

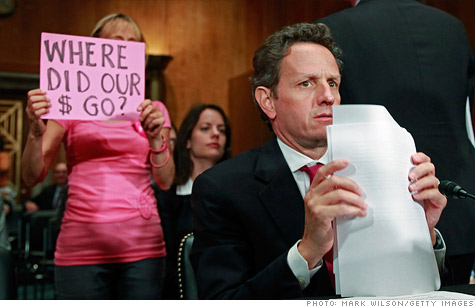

Questions about TARP fund spending shadow Treasury Secretary Timothy Geithner at a 2009 hearing.

WASHINGTON (CNNMoney) -- Treasury paid five law firms more than $27 million in fees to create contracts governing the TARP bailout of Wall Street banks, but law firms did a poor job of explaining what they did with the money, a watchdog said.

In several cases, the law firms either gave vague or no descriptions for work performed for the Treasury's Office of Financial Stability, which oversaw the $700 billion bailout program, according to a Thursday report released by the Special Inspector General for the Troubled Asset Relief Program

The Troubled Asset Relief Program is largely credited for stabilizing the financial sector. But it remains a political punching bag, as most of its programs aimed at helping Main Street have fallen flat.

The report also found the law firms didn't give "adequate support" for expenses charged the government. The law firms were hired to write the contracts between banks and the federal government governing the terms of the loans. Some were also involved in the bailout of the automakers.

"As a result, in some instances, OFS (Treasury's Office of Financial Stability) overpaid for legal services," the report found. However, the report stopped short of suggesting a total number by which Treasury may have overpaid.

The report also stated that while the inspector general questioned bills from all of the law firms audited, "this does not mean that all the fees and expenses SigTARP questioned were unreasonable."

Treasury spokesman Mark Paustenbach said Treasury considered the legal services "critical to the success of our programs."

"We believe the procedures we followed ensured that taxpayers received good value," he said.

In the case of the law firm Simpson Thatcher & Bartlett, the inspector general found that, for some of the $5.8 million in fees paid to the law firm, the firm "provided no details whatsoever. . .receipts or adequate documentation for its expenses as required in one of its contracts."

The inspector general was able to parse down in some cases and found that the federal government overpaid Simpson Thatcher some $69,000, because the law firm bill the federal government for work done by a foreign subcontractor, which hadn't been approved by Treasury.

In addition to Simpson Thatcher & Bartlett, the report focused on Cadwalader Wickersham & Taft, Locke Lord Bissell & Liddell, and Bingham McCutchen. An April report found similar problems with a fifth law firm, Venable.

A Simpson Thatcher firm spokeswoman said the firm is proud to work with Treasury.

"Our team of highly qualified lawyers worked closely with the Treasury staff on a daily basis to structure and implement TARP programs that played a key role in stabilizing the US financial system," the spokeswoman said.

A Locke Lord spokesman noted that the law firm billed about 1% of the total $27 million, reviewed by SigTARP.

"We are proud of the work we did for our client," said Julie Gilbert, the Locke Lord spokeswoman.

A Cadwalader spokesman also said the law firm is proud of the work they did "under incredible pressure" to restructure auto companies. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |