Search News

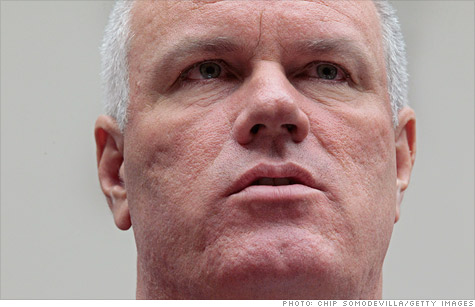

Brian Harrison, CEO of Solyndra, the solar company that received a $535 million government loan guarantee, has stepped down, according to bankruptcy court records.

NEW YORK (CNNMoney) -- It's lights out for embattled Solyndra CEO Brian Harrison.

The head of the bankrupt energy firm has resigned, according to documents filed in Delaware court this week, as the company finds itself embroiled in a mounting scandal that may leave the US government on the hook for over $500 million.

Harrison stepped down last week. The company proposed R. Todd Neilson of Berkeley Research Group to take his place, serving as "chief restructuring officer". His appointment to the position is subject to the bankruptcy court's approval.

"The CRO will assist the debtors in their ongoing efforts to sell estate assets, winding down the debtors' operations following such sale or sales, and otherwise managing the cases," the documents state.

Solyndra is a California solar panel manufacturer that had received $535 million in federal loan guarantees before it was forced to halt operations and file for bankruptcy at the end of August, putting more than 1,000 workers out of work.

Before its failure, the company had been touted as an example of the benefits of creating green jobs by the Obama administration. But since then, it has become the center of congressional criticism and a probe by the FBI.

Harrison and fellow Solyndra executive W.G. Stover were called before the House Subcommittee on Oversight and Investigations last month to testify on the case, maintaining that no wrongdoing took place at the company but repeatedly invoking their 5th amendment right not to answer questions.

Lawmakers are using the company's failure as a case study highlighting the danger of government funding for private firms. They want to know why one month before it filed for bankruptcy, the executives told them and the Department of Energy that the company was doing just fine.

Following last month's hearing, the Justice Department asked a judge to install a trustee in the case, saying the top executives' refusal to testify in the probe of the company made the additional oversight necessary.

Jason Kilborn, resident scholar at the American Bankruptcy Institute, said Harrison's departure was par for the course in bankruptcy cases.

"It's the rare Chapter 11 reorganization where the CEO or whoever was really in charge of the show doesn't step down or isn't removed," Kilborn said.

Analysts say the government may be able to recover some portion of the $535 million loan guarantee, whether through some form of buyout of Solyndra by another firm or a liquidation of its assets.

Neilson, Solyndra's proposed restructuring officer, is a former FBI agent and a seasoned reorganization professional, having served as bankruptcy trustee for clients including boxer Mike Tyson and hip hop mogul Suge Knight. He has also negotiated sales of ownership stakes in the Los Angeles Kings and Nashville Predators hockey teams, according to his bio on the Berkeley Research Group website. ![]()