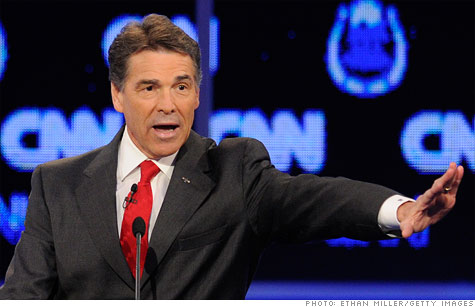

Texas Gov. Rick Perry is banking on a flat tax to appeal to voters fed up with the complexity of the current tax system.

NEW YORK (CNNMoney) -- Step aside 9-9-9. A new flat tax proposal is coming to town.

On Tuesday, Republican presidential candidate Rick Perry will propose an economic growth package that includes a flat tax.

"It starts with scrapping the three million words of the current tax code, and starting over with something much simpler: a flat tax," Perry said last week.

Perry's not alone. In an email to supporters on Sunday another GOP presidential hopeful -- Newt Gingrich -- said he would propose an "optional flat tax."

So what's a flat tax exactly?

Typically it's proposed as a replacement for the income tax.

One tax rate: What makes a flat-tax system "flat" is that there is only one tax rate, whereas today's system has a series of rates.

And a flat tax includes an exemption based on family size -- similar to today's standard deduction -- that everyone can take.

In a pure flat-tax system, that exemption would be the only tax break anyone gets. Today's tax code, of course, has a complex array of tax credits, deductions and exemptions.

Flat-tax proposals can differ from one another in several ways: how high they set the rate; how big they make the exemption, how many other tax breaks they allow and whether they eliminate the payroll tax and the estate tax.

But the more taxes a flat-tax system seeks to replace and the more tax breaks it allows, the higher the rate must be to generate enough revenue.

Tax-free return on savings: Another key difference between a flat tax and today's income tax is how the two treat savings.

In a flat-tax system, interest, capital gains and dividends are in essence tax-free. The goal is to only tax money once -- either when it is initially earned or when it is withdrawn after being deposited or invested.

Today's system is a "hybrid" in that regard, according to tax expert William Gale.

Sometimes it only taxes savings once, such as when you use pre-tax money to invest in a 401(k) and pay taxes when those savings are withdrawn.

But the current code also taxes many capital gains, dividends and interest, although often at a lower rate than wage income. Some people think that "any capital income tax is basically a 'double tax' on labor earnings," said economist Diane Lim Rogers of the Concord Coalition, a deficit watchdog group.

That's because the income a person may use to make the investment has been taxed once and then the money those investments generate is also taxed.

"But to those who believe that income is the proper basis of taxation, capital taxes aren't double taxes at all -- they're just taxing capital income analogously to labor income," Rogers said.

In the case of dividends, there may be more of an argument that they're double taxed: They're taxable to the shareholder who receives them, and they are not deductible from the profits of the company that pays them.

The potential downside: So what's not to like about a flat tax?

Proponents promise that a flat tax will be simpler, fairer and better for the economy than today's code.

But that's not necessarily true. A lot will depend on the details.

In terms of simplicity, if the flat tax system has just one rate and one exemption, tax preparation likely would be much simpler than it is today.

Especially for businesses. They would be taxed at one rate on gross receipts minus all outlays -- everything from wages to the purchase of new equipment. Today, different types of business expenses are treated differently.

But even under a flat-tax system, lawmakers would still feel pressure to include breaks for special groups. That could increase complexity and taxpayers' sense that it's always the other guy getting a break.

And a lot of adjustments may be needed to ensure a flat tax doesn't hit the poor too hard.

In theory, the flat-tax exemption is designed to help reduce the tax burden on the lowest-income households, said Jim Nunns, a senior fellow at the Tax Policy Center.

But that may not be enough. To prevent the poor from getting saddled with a heavy tax burden, it may be necessary to retain some tax breaks, such as the Earned Income Tax Credit.

Meanwhile, the wealthiest taxpayers would likely see their tax bills fall. "Certainly, high-income people will pay less," Nunns said.

Indeed, critics are not convinced that a flat tax would be better in terms of fairness or economic efficiency, especially once the costs of transitioning to a new system are factored in.

In fact, they say, those goals might be achieved more readily by making smart changes to the current system -- for example, by lowering income tax rates and eliminating many of the tax breaks.

Such a change doesn't have a catchy name. But it does have proponents on both sides of the aisle in Congress.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |