Search News

NEW YORK (CNNMoney) -- Don't expect any hugging or kissing. But Democrats and Republicans may eventually at least hold hands in solidarity over one big idea: Scale back or eliminate tax breaks in exchange for lowering rates.

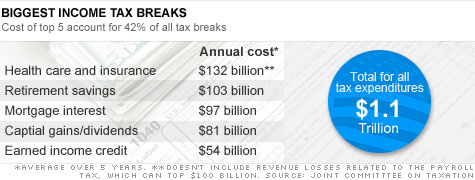

Today, there are dozens of tax credits, deductions and exclusions that cost federal coffers more than $1 trillion a year. That's a little more than a third of all annual federal spending.

Of course, coming to bipartisan agreement on which tax breaks to ax -- and whether some of the revenue raised as a result should be used to reduce deficits -- is another matter.

But if lawmakers are serious about overhauling the code in a way that substantially reduces rates, they'll have to address the biggest and most beloved tax breaks. (See what President Obama's bipartisan debt commission proposed.)

Cost: $132 billion a year on average, not including revenue losses related to the payroll tax that can top $100 billion.

Why it exists: The tax break, which applies to employer-sponsored insurance plans, is intended to boost health insurance coverage.

When an employer pays for part of a worker's coverage, that subsidy is treated as tax-free income to the worker. There is no cap on how big that subsidy may be. And in many cases, a worker's contribution is taken from pre-tax income.

Health spending experts note that the unlimited nature of the tax-free subsidy encourages more use of health care than needed and drives costs higher.

The health reform law enacted last year included a provision that will impose a tax on very high-cost plans starting in 2018. Fiscal hawks, however, say it doesn't go far enough in encouraging judicious use of health care.

Who benefits: People whose employers provide health insurance -- typically those who work at large companies. Roughly 160 million Americans get their health insurance through their employers.

The break disproportionately benefits high-income workers.

Small companies have a harder time finding affordable coverage, so workers there don't benefit as much and the self-employed don't get as generous a tax break when they buy coverage.

Lastly, the break does nothing to help the roughly 50 million uninsured.

Proposals to reform it: Cap, then gradually phase out how much workers may receive in tax-free subsidies and how much they may contribute that is tax advantaged. (Think you're smart about deficits? Take the CNNMoney quiz.)

Cost: $103 billion a year.

Why they exist: To help ensure that Americans have adequate savings in retirement.

Depending on the account -- defined contribution 401(k) vs. defined benefit pension, a traditional IRA vs. a Roth or a SEP -- contributions may grow tax-free or tax-deferred and contribution limits differ. Employer contributions to a workers' plan are also tax advantaged. And early withdrawals may be made in some instances without penalty.

But the bevy of retirement savings breaks and the conflicting rules that apply to each have been described by budget experts as "bewildering," "regressive" and "expensive."

Who benefits: Anyone who has money to save, especially those with work-based retirement plans and higher income workers. Beyond that, limits on one's ability to use a given break depend on income, contributions to similar plans and whether there is sufficiently broad participation in a workplace savings plan.

Proposals to reform it: Streamline the number of breaks and cap the amount of tax-favored contributions to, for example, $20,000 or 20% of income. Make it more difficult for high-income earners to convert taxable assets into tax-free retirement savings. Expand the savers credit for low-income taxpayers.

Cost: Close to $100 billion a year on average.

Why it exists: The mortgage interest deduction dates back to 1913. Interest of any kind at the time was treated as a deductible expense of business and investment income, according to a Tax Policy Center paper.

Proponents today argue that the deduction spurs homeownership, which in turn can boost various industries and thereby support the economy.

But studies indicate that its role in that respect is not cost-effective. "Its main beneficiaries are not individuals on the margin between renting and owning. ... [M]ost benefits from the deduction are concentrated at the high end of the income distribution, where homeownership rates are likely to be high with or without the deduction," the paper's coauthors noted.

And it may push home prices higher in some markets, since homeowners may choose to pay more for a house than they would without the break.

Who benefits: Homeowners who itemize deductions. Itemizing only makes sense when the value of the total deductions exceeds the standard deduction.

The mortgage interest deduction was claimed on just 22% of all returns in 2009. High-income filers tend to benefit disproportionately because they are more likely to itemize.

Proposals to reform it: Limit the value for high-income individuals. Restrict use to primary residences only. Cap the size of the mortgage or the amount of interest on which the deduction may be taken. Convert the deduction to a credit so every homeowner can claim it. (Take the CNNMoney debt quiz.)

Cost: $81 billion a year on average.

Why it exists: Long-term capital gains and qualified dividends are taxed at 15%, lower than most ordinary income. Proponents say that encourages investment and reduces double taxation since at least some of a gain or dividend may also be taxed at the corporate level. They also said it may prevent investors from holding on to an investment too long.

But the 15% rate disproportionately benefits the wealthy, who are more likely to invest. It also encourages tax sheltering as some try to convert ordinary income into capital gains, according to the Tax Policy Center.

Who benefits: Anyone who owns investments -- such as stocks or a home.

Proposals to reform it: Raise the rate to 20% for high-income families. Tax gains and dividends at ordinary income tax rates, but that rate may be lower than it is currently if the code is reformed and income tax rates are lowered across the board.

Cost: $54 billion a year on average.

Why it exists: Created in the mid-1970s, the earned income tax credit is intended to help the working poor by offsetting the Social Security tax burden and providing an incentive to work.

The EITC is worth between $457 and $5,666. It is a refundable credit, meaning eligible tax filers get paid the full amount they qualify for even if it exceeds their income tax liability.

Eligibility is based on income and the number of dependents.

But because the IRS has a hard time verifying whether a claimant is accurately claiming the right number of dependents, there is a high improper payment rate -- $17 billion worth in 2010, according to the Government Accountability Office. Among the reasons: high turnover of eligible claimants, confusion among them, complexity, structure, unscrupulous tax preparers and fraud.

"It gets more money out to the people who it should be getting out to, but there are these tradeoffs," Tax Policy Center co-director Eric Toder told Tax Analysts earlier this year.

Who can use it: Roughly 24 million taxpayers benefit. Several variables determine who gets the credit. In 2010, singles with no children had to have earned income below $13,462. A married couple filing jointly with three children had to have earned income below $48,362.

Proposals to reform it: There have been various calls by lawmakers to improve the design and administration of the tax credit. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |