Cirque's Lalibert�: "I feed on challenge."

FORTUNE -- Guy Laliberté, 52, started as a fire-breather and stilt-walker in Quebec, where he organized street festivals. He ended up running an entertainment empire with nearly $1 billion in sales, Cirque du Soleil, known for spectacular artistic and acrobatic shows seen around the world. Here's how he did it.

My first dream was to travel. I was attracted to different places, different colors of skin, different food. When I was 18 in 1977, I went to Europe with my accordion and discovered the pleasure of entertaining people. I come from a middle-class family whose parents dreamed of their children becoming doctors or lawyers. When I came back and told my parents [Blandine and Gaston Laliberté] I wanted to be a creative producer and artist, and would not go to university, there were a lot of tears.

I was first a street artist, performing in a theater troupe on stilts, and started a festival of street performers in Quebec. Up to then, the attitude was: Invite the street performers, pay them a sandwich, and they'll be happy. You managed the money you got out of the hat and learned to be disciplined with what you got.

In 1984 the Canadian government had a cultural budget for the celebration of the 450th anniversary of Jacques Cartier's discovery of Canada. They asked us, the street performers, to develop an artistic concept that would carry the festivities out across the province. It was our dream to create our own circus, so I took charge and became the producer. I was able to get our first contract from the government for $1 million. It was a contract, not a subsidy.

Our first tour was under a blue-and-yellow big top that seated 800, and Cirque du Soleil became the popular success of the summer. Cirque du Soleil means Circus of the Sun. When I need to take time to reenergize, I go somewhere by the ocean to sit back and watch the sunsets. That is where the idea of "Soleil" came from, on a beach in Hawaii, and because the sun is the symbol of youth and energy. For the government, that first effort was a one-year event, but it was our big break to learn things and continue to dream.

In the beginning I did everything, like everyone did. I helped to put up the tent, did marketing, did the artistic direction. We had about 10 acts in the show, with trapeze artists, stilt-walkers, clowns, and contortionists. I did fire-breathing. After that first show in Gaspé, we started a 15-city tour in Quebec. By the time we got to Montreal, we pretty much knew how to do things. By the end of the tour I knew we could succeed, but the only way this could become a business was if we could leave Canada during the winter months. Six months of tours would not ensure a business.

So the next year, in 1985, we had to restart negotiations with the government to get a subsidy, and ended up with a huge debt. I negotiated with vendors and met with 20 bankers in two weeks. We had the big top from the first show, but they all asked, what will we do with a big top if you fail? We were lucky to find a community bank in Quebec that took a huge risk and allowed us to go over our credit line by $350,000.

We were then invited to the Los Angeles Festival of the Arts by Thomas Schumacher, who was then their associate director. I made a deal, accepting to go if we were the opening act. I packed the room with celebrities and influencers like Sylvester Stallone, Arnold Schwarzenegger, and executives from Columbia Pictures. If they liked us, we could secure a U.S. tour. If they didn't, then I would sell the big top to bring everyone back home. It was a huge success, and in 1987 we started to make money.

The next year we did shows in Santa Monica and New York and had millions in profit. We had moved from feeling like a small family enterprise to a midsize company with an international twist. We were grant-free in 1989. Back then, the worst challenge for me was dealing with the doubt of some of the people who worked for me. I feed on challenge, but also on love and support. I was managing a community of artists who came from the street. I wanted to use the revenues we were generating to immediately start a new production, to have two productions touring and ensure a viable growth. But when I proposed this to the others, they reacted negatively. They would have preferred to benefit immediately from the hard work they were doing. They did not understand that we had to keep reinvesting in new productions to ensure longevity. I explained it would be the difference between touring for one year and touring for a few years. Some people left, but most stayed.

So we began touring in Europe in 1990 with shows in London and Paris, then opened in Japan. In 1990 we sold 120,000 tickets, with an average price of $23. Steve Wynn saw one of our touring shows and called us. In 1992, Las Vegas was an undeveloped territory. The capitals of live entertainment were London and New York. Entertainment was used by casinos as giveaways to customers as perks. My first venture in Vegas was with Caesars Palace. They dropped out of the deal at the last minute because they thought the show (Mystère) was too esoteric. Steve wanted it for the Mirage Resorts. So sometimes a failure turns out to be the best success. Mystère in its first year did 480 shows, with 92% occupancy, so it was a big success!

After that, we kept expanding and expanding with more shows and more tours. Alegría, Saltimbanco, O, and on and on. I wanted to use our success to make a difference in the world. So in 2007 I pledged $100 million of my personal money to the cause of clean water issues and started the One Drop Foundation, and in 2009 we celebrated Cirque's 25th anniversary. In 2010 we sold more than 10 million tickets, and our average ticket price is $75.

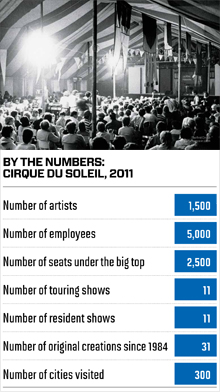

We now have more than 5,000 employees representing 57 nationalities around the world. While the recession has had an impact, we are still doing well. Having seven shows in Vegas, we repackaged pricing with ticket discounts. Our security reserve is okay, and we're a cash-flow company without a huge debt. We developed a fleet of shows in different markets. Now, we have great revenue in Europe when the dollar is weak.

I've always been able to finance the shows on my own. Could I grow bigger by going public? Probably. But I wouldn't be capable of doing the road show for banks. I've established the organization I wanted.

My Advice

Build humanitarian aid into the business model. There are more and more products with fewer people able to consume them. We have to help those who don't have the economic stability to grow, or one day there will be very few who are able to buy what we're selling. A percentage of our business has always gone to philanthropic efforts.

Trust the young. Young people have a lot to contribute, but generation after generation, those who reach power protect that power, rather than teach others how to attain it. I resolved that if I ever became successful, I would trust the young.

Be a part of the community where you do business. We installed our headquarters in one of the lowest-income areas of Montreal. We planted fruit and vegetables that we use in our own kitchens and give to the community, instead of building fences. Government can't do everything. The economic mortar worldwide is business.