Search News

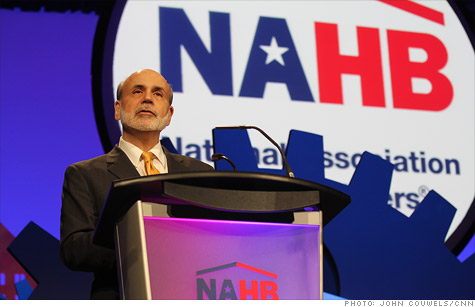

Federal Reserve Chairman Ben Bernanke speaks before the National Association of Home Builders Friday.

NEW YORK (CNNMoney) -- Lingering problems in the housing market continue to restrain America's economic recovery and limit the effectiveness of Federal Reserve policies, Ben Bernanke said Friday.

"The economic recovery has been disappointing in part because U.S. housing markets remain out of balance," the Fed chairman said in prepared remarks at the International Builders' Show in Orlando, Fla.

Federal Reserve policies meant to drive down long-term interest rates have had "less effect... than they otherwise would have had," he said, as even creditworthy households find it difficult to obtain mortgages or refinancing.

Bernanke cited statistics that show home prices are down 40% nationally from their peak, after adjusting for inflation. He estimates the decline in home prices has resulted in more than $7 trillion in lost household wealth.

"It appears the recent declines in housing wealth may be reducing consumer spending between $200 billion and $375 billion per year," he said. "That reduction corresponds to lower living standards for many Americans."

Bernanke suggested a plan that would turn foreclosed properties into rentals could help unload some of the excess housing in some markets -- a repeat of a policy he also examined in a white paper last month.

"With home prices falling and rents rising, it could make sense in some markets to turn some of the foreclosed homes into rental properties," he said. But it's not a "silver bullet," he added.

The speech comes a day after five of the nation's largest banks struck a deal with 49 states to settle charges of abusive and negligent foreclosure practices dating back to 2008.

Under that deal, Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Wells Fargo (WFC, Fortune 500) and privately held Ally Financial will commit $26 billion to help underwater homeowners and compensate those who lost their homes due to improper foreclosure practices. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |