Search News

Facebook's IPO price is available to the deal's underwriters and their bigwig clients. Regular folks will get to buy at market price the next day.

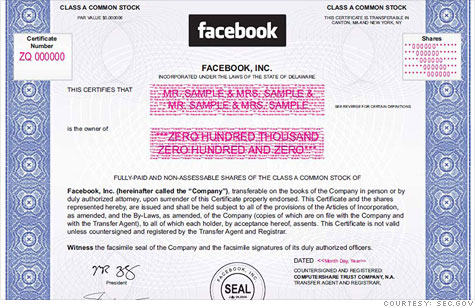

NEW YORK (CNNMoney) -- Facebook's long road to an initial public offering is coming to an end. Late Thursday, it will fill in one last piece of the puzzle: Its final IPO price.

That's the price at which Facebook's underwriters (including lead banker Morgan Stanley) will sell shares to their clients, which typically include large institutional investors, mutual funds and hedge funds. Some shares were made available to individual investors, but getting them typically requires either a lot of money or a lot of trading experience.

It also required moving fast. Many brokerages offering pieces of Facebook's IPO allotment "closed their books" on Tuesday, meaning they stopped taking orders.

Facebook currently plans to price its shares in the $34 to $38 range, but that target isn't binding and could still rise. The offering is expected to be heavily subscribed -- investor response has been "nothing short of pandemonium," one source familiar with the discussions told CNNMoney.

Facebook first filed its IPO paperwork on February 1 and has updated its filings eight times since then with additional details and new financial disclosures. Barring any unexpected complications, the Securities and Exchange Commission will officially certify the offering "effective" on Thursday.

After Facebook gets the regulatory green light, the company will work with its underwriters to set its final price. Shares will then be released to those who have agreed to buy them.

When can I buy? Ordinary investors looking to get a piece of Facebook will have to wait until the next morning. Unlike Google (GOOG, Fortune 500), whose IPO used a "Dutch auction" to allow direct bidding by investors, Facebook's setup doesn't give regular folks access until shares begin trading publicly.

Those "regular" investors will get access to Facebook shares the morning after the price is set, when the stock begins publicly trading on the tech-heavy Nasdaq exchange. That's currently slated to happen Friday.

While the market opens at 9:30 am, Facebook's shares won't start trading instantly. It typically takes time -- sometimes an hour or more -- for newly listed shares to begin actively trading on the day of their public debut.

In response to heavy demand, Facebook said early Wednesday that it will sell about 25% more shares than it had originally planned, bringing its total IPO offering to 421 million shares. Those additional shares will come from selling shareholders, not Facebook itself.

That means Facebook could raise as much as $16 billion in its IPO. That would make it the largest tech IPO in history -- and the third largest U.S. IPO ever, trailing only the $19.7 billion raised by Visa (V, Fortune 500) in March 2008 and the $18.1 billion raised by automaker General Motors (GM, Fortune 500) in November 2010, according to rankings by Thomson Reuters.

Overall, Facebook would be the 11th largest global IPO in history.

How much Facebook is worth: If Facebook (FB) prices at the high end of its proposed per-share range, the company's market capitalization would hover around $81 billion on the day of its IPO.

Many Facebook employees and executives hold unexercised stock options. If all of those shares were exercised, Facebook's outstanding share count would rise to around 2.8 billion -- pushing the company's total valuation closer to $106 billion.

Who's selling shares: Facebook CEO and founder Mark Zuckerberg plans to sell 30.2 million shares in the IPO offering. If Facebook prices at the top of its range, that will net Zuckerberg about $1 billion.

But Zuckerberg won't be hanging on to his cash. Facebook said he will use the "substantial majority" of the windfall to cover the massive tax bill he'll be hit with, thanks to his plan to exercise a large stock-options grant that will increase his ownership stake in the company he founded.

After the offering, Zuckerberg will hold 503.6 million shares, or about 31% of the company. That stake would be worth $19.1 billion if Facebook prices at the top of its current range.

Venture capital firm Accel Partners, which is the largest shareholder outside of Zuckerberg, is selling 49 million shares in the offering. That's about a quarter of its Facebook holdings.

-- CNNMoney's Chris Isidore and Maureen Farrell contributed reporting. ![]()