Search News

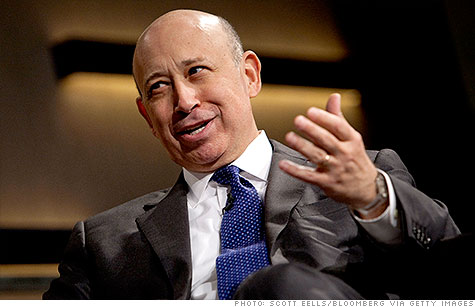

Lloyd Blankfein of Goldman Sachs offered Washington advice to fix its woes, and urged investors and companies to buy American.

WASHINGTON (CNNMoney) -- Goldman Sachs CEO Lloyd Blankfein says the Libor scandal's "biggest impact" is a blow to the integrity of the financial system "that has already been undermined so substantially."

"There was this huge hole to dig out of in terms of getting the trust back, and now it's just that much deeper," said Blankfein, in comments Wednesday at the Economic Club of Washington. "That's going to be a big burden for all of us."

In a forum that covered taxes to financial reforms, Blankfein said the scandal's blow to public trust was even more worrisome than potential liability from lawsuits against banks that set or use Libor.

Goldman Sachs (GS, Fortune 500) is not one of the U.S. banks involved in setting the key financial benchmark.

The Libor rate -- currently used to calculate trillions of dollars in consumer and business loans around the world -- has been in the spotlight since revelations that Barclays (BCS) manipulated Libor to benefit trades and its own bottom line.

Barclays agreed last month to pay U.S. and British regulators some $450 million to settle charges of manipulation, which has weakened trust that banks are setting rates on loans fairly and honestly.

When asked about the Wall Street reforms enacted in the Dodd-Frank Law two years ago, Blankfein expressed support for rules forcing banks to hold more capital, saying they are especially helpful in avoiding another financial crisis.

But he used less kind words to describe the Volcker rule, which bans Wall Street banks from so-called proprietary trading on their own accounts.

"I think the Volcker rule addressed issues that were not the problems," Blankfein said.

Volcker proposed the rule so big banks wouldn't be bailed out by the Federal Reserve in the future for making big risky bets intended to chase big profits.

Since 2009, Goldman Sachs has spent nearly $15 million on lobbying, mostly on rules about bank capital cushions, swaps and the Volcker rule.

In a op-ed piece that ran Wednesday in Politico, Blankfein offered suggestions to make the United States more attractive for investment, such as fixing the long-run budget deficits, making it easier for legal immigration and investing in infrastructure.

Blankfein embraced the so called Bowles-Simpson plan for balancing the budget and cutting the national deficit, calling it "serious, responsible and bipartisan." Democrat Erskine Bowles and Republican Alan Simpson co-chaired a debt reduction panel commissioned by President Obama.

He also said that lawmakers should approve a bill that allows companies to bring foreign profits back to the United States from overseas, without having to pay big tax penalties. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |