Investors will be parsing through plenty of Fed speak Tuesday as members of the Federal Reserve take the podium at different events.

The new head of the Federal Reserve, Janet Yellen, released a statement on her monetary policy report before the bell.

Yellen said she anticipates that the economy and job market will grow at a "moderate pace" this year and the next, with unemployment continuing to decline. As for monetary policy, she expects "a great deal of continuity" from the Federal Open Market Committee.

She is scheduled to testify before the House Financial Services Committee at 10 a.m. ET. This will be her first appearance since taking the helm of the central bank earlier this month.

Investors will be watching to see if she sheds any light on plans to continue easing the Fed's stimulus program, a big driver of the 2013 stock market rally.

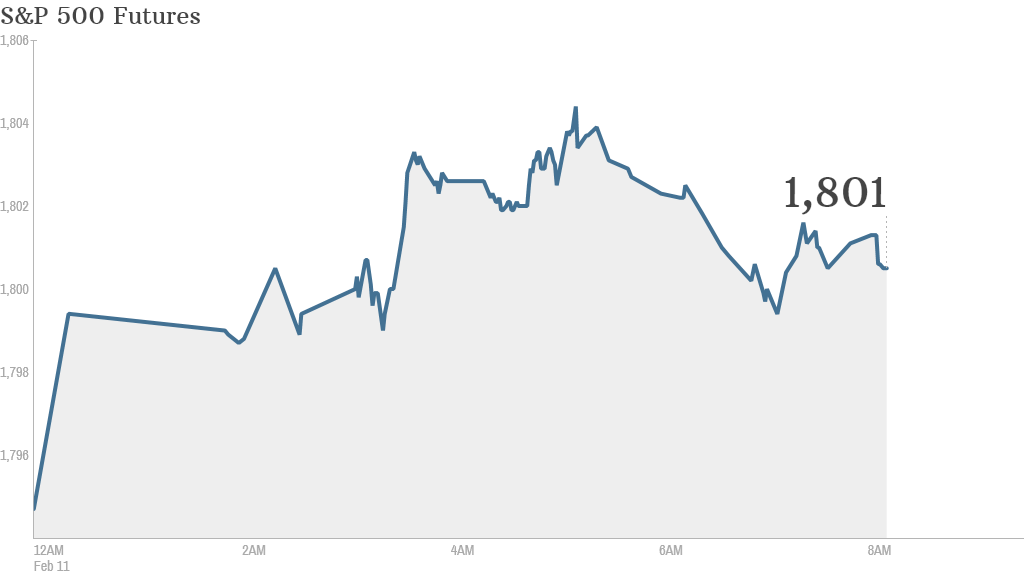

U.S. stock futures were moving up, with market players hoping for reassurance that the Fed will do all it can to ensure the economic recovery is on a firm footing.

Philly Fed president Charles Plosser is also due to speak Tuesday morning at the University of Delaware.

Then at 8 p.m., Richmond Fed president Jeffrey Lacker will discuss financial stability at the Stanford Institute of Economic Policy Research.

Related: Fear & Greed Index still in extreme fear

On the earnings front, utility company PG&E (PCG) will report before the opening bell. Fossil (FOSL) and TripAdvisor (TRIP)are releasing results after the close.

Sprint (S) shares surged in premarket reporting after the telecom reported better-than-expected improvements in its quarterly loss and also added subscribers.

CVS Caremark (CVS) shares jumped after the drugstore chain reported quarterly increases in sales and profit year-to-year.

Sprint

Shares of cloud-computing firm Rackspace Hosting (RAX) fell 10% in premarket trading after CEO Lanham Napier said he would retire.

Shares in British bank Barclays (BCS) fell by roughly 7% in London after it reported a big decline in fourth quarter earnings and said it would cut up to 12,000 jobs.

ETX Capital market strategist Ishaq Siddiqi said investors are growing concerned about CEO Antony Jenkins' ability to run Barclays. The bank's plunging profit and soaring costs "rattle[d] confidence in CEO Jenkins' ability to turn around the business by changing the culture, reshaping the balance sheet and repairing the bank's reputation."

European markets were broadly higher in morning trading, led by gains in Germany's DAX.

Asian markets closed with sizable gains, with the Hang Seng in Hong Kong posting a 1.8% jump. The Tokyo Stock Exchange was closed for a holiday.

Meanwhile, the Dow Jones industrial average, S&P 500 and Nasdaq all closed slightly higher Monday.