Investors and traders are readying themselves for a big day of earnings, with quarterly reports expected from many large U.S. retailers.

Barnes & Noble (BKS), Target (TGT), Abercrombie & Fitch (ANF) and TJX (TJX) are all set to release earnings before the market opens.

Then, after the close, Baidu (BIDU) and J.C. Penney (JCP) will report results.

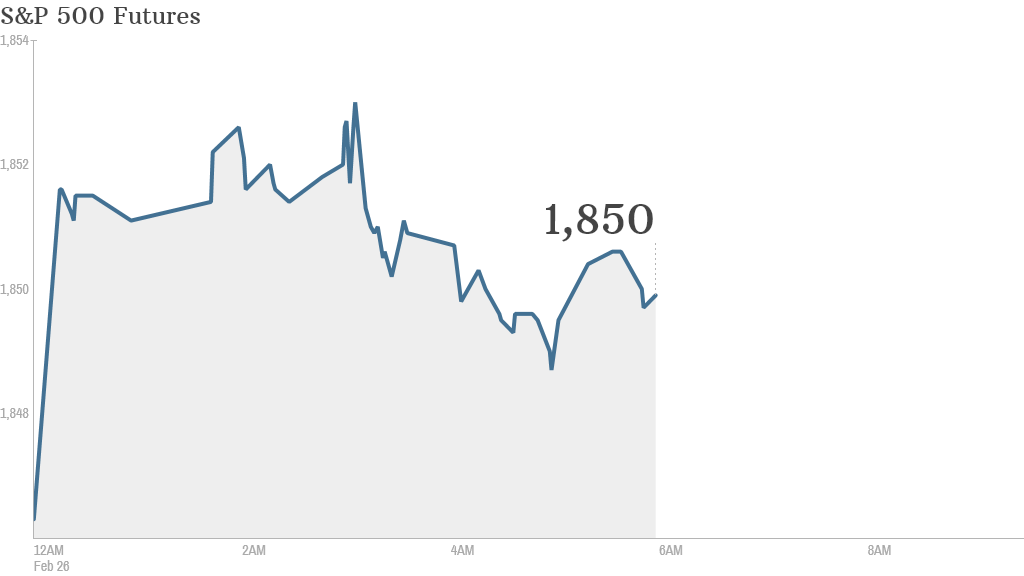

U.S. stock futures were ticking higher ahead of the opening bell.

Among the companies set for gains when the market opens is Anheuser-Busch InBev (BUD).

The global brewer, which makes popular beers including Budweiser and Stella Artois, reported better-than-expected fourth quarter results and outlined plans to boost sales during the upcoming FIFA World Cup in Brazil.

Meanwhile, Credit Suisse (CS) shares could slip after a Senate report released Tuesday outlined how the Swiss bank helped clients hide billions from the IRS. The bank's executives will appear before the Senate Wednesday.

Shares in First Solar (FSLR) are set for a big fall after reporting earnings that missed expectations. The stock was down by roughly 15% premarket.

Gun company Sturm Ruger (RGR) reported gains in sales and profit after the close Tuesday.

Related: Fear & Greed Index, still greedy

In economic news, data on January sales of new homes will be announced at 10 a.m. ET Wednesday.

Investors are also awaiting testimony from Federal Reserve Chair Janet Yellen on Thursday, which is likely to affect market sentiment.

U.S. stocks slipped slightly Tuesday. The Dow, S&P 500 and Nasdaq all fell modestly.

European markets were broadly lower in morning trading. The FTSE 100 in London was declining by roughly 0.4%.

Asian markets ended with mixed results -- the main indexes in Australia and Japan moved slightly lower while other markets posted gains.

The yuan has been dropping in recent days, shaking confidence in the typically robust Chinese currency.

The price of Bitcoin continued to slide following the shutdown Monday of leading exchange Mt. Gox.