Welcome to Wednesday.

With any luck, stock markets will continue hitting more record highs.

Here are the four things you need to know before the opening bell rings in New York:

1. Up, up, up: Take a look across global equity markets and you'll see a lot of green.

European markets are rising in early trading as reports indicate Greece will ask for a six-month loan extension from its European creditors, which would help it avoid running out of money and stumbling out of the eurozone.

Some indexes, including the FTSE 100 in London and the Dax in Germany, are trading at or near record highs.

"There is a feeling that a lifeline will be cast out to save the Mediterranean nation," said David Madden, a market analyst at IG.

Asian markets closed with gains. The Nikkei 225 in Japan jumped by 1.2%, putting it at a level not seen since 2007. This came after the country's central bank announced it would continue its massive stimulus program.

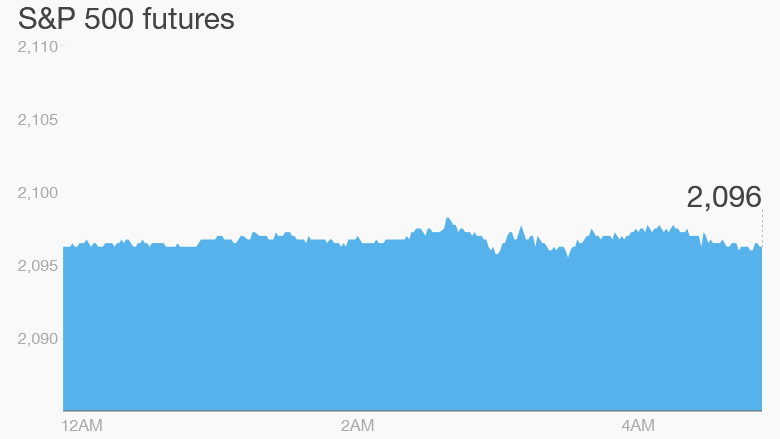

Over in the U.S., stock futures are holding steady.

On Tuesday, the Dow Jones industrial average gained 28 points, while the S&P 500 rose 0.2%, hitting a record high. The Nasdaq edged up 0.1%.

2. Stock market decliners -- Exxon Mobil, Carlsberg: Investors are reacting to new filings that show famed investor Warren Buffett dumped his stakes in oil companies Exxon Mobil (XOM) and ConocoPhillips (COP). Shares in Exxon Mobil are off by about 2% premarket.

Many investors like to follow Buffett's trading strategies, which often create ripple effects across markets.

Meanwhile, shares in Carlsberg (CABGY) are dipping by 2% in Copenhagen after the company announced a fall in annual profits and also said its CEO was retiring. The beer brewer has been facing difficult business conditions in Russia and Eastern Europe.

3. Earnings: Hilton Hotels (HLT) and Hyatt Hotels (H) will report earnings before the opening bell.

Marriott (MAR), SolarCity (SCTY) and the massive gold miner Barrick Gold (ABX) report after the close.

4. Economics: The U.S. government is releasing January housing starts and building permit numbers at 8:30 a.m. ET.

At 2 p.m. the Federal Reserve will release the minutes from its latest monetary policy meeting.

Over in the U.K., new figures show the jobs market keeps improving, with unemployment down to 5.7% at the end of 2014.

Russian unemployment figures are also expected sometime after 8 a.m. ET. Russia has been struggling over the last year with lower oil prices and international sanctions, which have hurt the nation's economy and pummeled the ruble.