The whiff of a trade war has prompted falls in global stock markets.

President Trump alarmed investors on Thursday by announcing heavy tariffs on steel and aluminum imports. He followed that up Friday with a tweet that said "trade wars are good, and easy to win."

Investors are worried that Trump stance could set off a wave of protectionist policies across the globe that will hurt businesses and the economy.

US stock futures were sharply lower.

Benchmark indexes in Frankfurt and Paris shed roughly 2% in early trade, while stocks in London dropped by 1%. The Nikkei dropped 2.5% in Tokyo, while Hong Kong stocks slid 1.5%.

"Trump's announcement not only increases the specter of a global trade war but also neatly highlights the fracturing of the global compact which has been in place over recent decades," Greg McKenna, chief market strategist at currency trading platform AxiTrader, said in a note to clients.

Related: Some of America's top allies are really, really angry about Trump's tariffs

Trump said his administration would impose a 25% tariff on steel imports and a 10% tariff on aluminum.

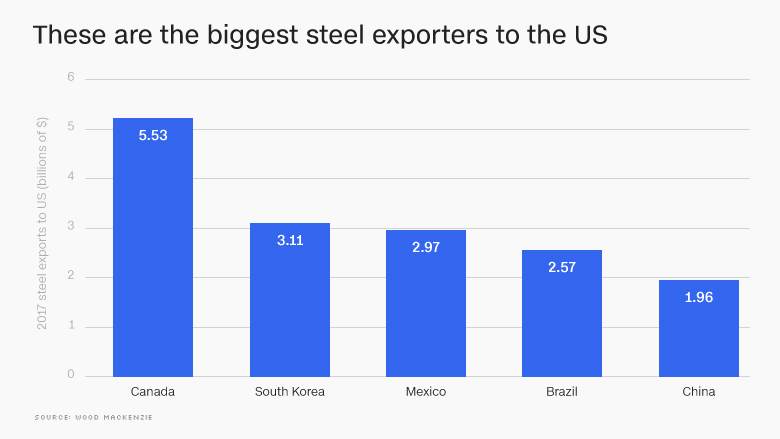

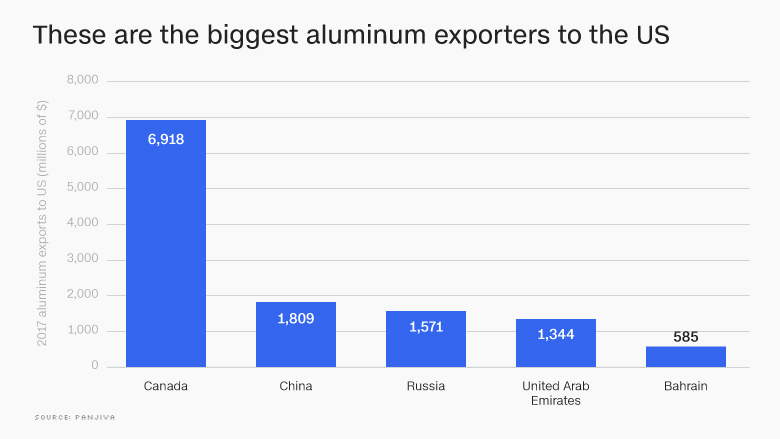

Investors are worried how major US trading partners like China, Canada and the European Union will respond.

"Markets are particularly vulnerable if we see retaliatory moves," said Ric Spooner, chief analyst at stock broker CMC Markets.

If more and more countries put up tariffs on goods coming into their territory, that could push up prices for consumers and depress global trade, which has helped spur recent growth in many major economies around the world.

"Trade is just about the only thing economists are agreed on -- more is better," Rob Carnell, chief Asia-Pacific economist at Dutch bank ING, wrote in a research note.

Trump's announcement dealt a direct blow to US stocks on Thursday. The Dow fell nearly 1.7% Thursday, while the Nasdaq and S&P 500 both declined 1.3%.

Related: Trump's new tariffs could make beer, cars and baseball bats more expensive

Analysts in Asia are paying particular attention to what happens in the relationship between the world's two largest economies, the US and China.

While steel and aluminum make up just a small part of China's exports to the US, Trump's move "is expected to invite the ire" of America's largest trading partner, Jingyi Pan, a market strategist with investment advisory firm IG, said in a note to clients.

Shanghai's main stock index fell 0.6% Friday. The losses were smaller than for some other markets in the region because Shanghai stocks had already suffered a big correction in the past month, according to analysts.

For now, investors are taking a "wait and see approach" to how the Chinese government responds to Trump's latest move, said Dickie Wong, director of research for Hong Kong broker Kingston Financial.

Related: Dow drops more than 400 points after Trump announces tariffs

Some steel producers took a big hit. China's Baoshan Iron & Steel and Japan's Nippon Steel (NISTF) both dropped nearly 4%.

European steelmakers, which were slammed late on Thursday, posted further losses. Germany's ThyssenKrupp (TKAMY) dropped 3%, while Salzgitter (SZGPY) shed 5%. Industry leader ArcelorMittal (AMSYF) declined more than 4%.

Companies that have strong ties to the US fared better, with investors hoping their American operations could enable them to avoid the worst effects of the tariffs.

Australia's Bluescope Steel, which has a mill in Ohio, climbed 1.2%. And Japanese steelmaker Yamato Kogyo, which has a joint venture with US firm Nucor (NUE), gained 1.4%.