Recent buyout fundraising: $23 billion

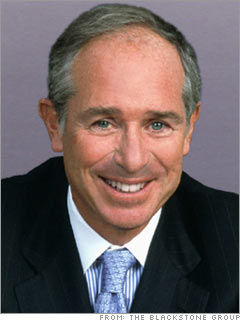

Description: Since opening its doors with $400,000 in 1985, Blackstone has become known for sharp elbows and sharper deals. Witness its $3.8 billion buyout of Celanese in 2004: The firm put in $650 million in equity and almost immediately recouped $500 million with a junkbond offering. Or the way it unloaded $13 billion worth of buildings in its recent $38.9 billion buyout of Equity Office Partners before the ink was dry on the deal. As a hedge against a cyclical downturn in private equity, co-founder and CEO Steve A. Schwarzman has diversified the firm into hedge funds, distressed debt, asset management, and oh, yes, real estate. Moreover, the 60-year-old designated CSFB alum Hamilton "Tony" James president and his de facto successor in 2004.

Boldface advisors: Former Treasury Secretary Paul O'Neill.

Fun Fact: Co-founder Pete Peterson counts Alan Greenspan and Henry Kravis as golf buddies.