The headwinds facing the economy are still daunting, says Rob Arnott, chairman of Research Affiliates, so stick to defensive plays in the bond market. But make sure to also capture global exposure, including debt from emerging markets.

"I think we have a very real risk that the recovery will stall, and the bond market is priced to reflect that expectation, but the stock market could take another hit," Arnott said. "I strongly favor global diversification because the U.S. debt is getting out of hand."

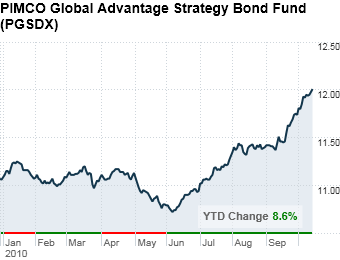

Arnott is a fan of Pimco's unconventional Global Advantage Strategy Bond Fund which tracks an index that differentiates itself from most by assigning the highest weight to issuers with the greatest economic activity instead of those with the greatest amount of outstanding debt.

"If you own bonds, you're a lender, so assigning weight by the size of the economy presents an enormous advantage," Arnott explained. "If you use the market capitalization method, you are lending those are heavily indebted."

So far this year, the fund, whose top holdings include Canadian, German and American debt, is up more than 8%.

NEXT: Spread your risk