FSB 100

|

Video

-

Carrizo Oil and Gas' 3-D seismic surveys reveal a wealth of natural gas and oil in the North Texas Barnett Shale. Watch

Carrizo Oil and Gas' 3-D seismic surveys reveal a wealth of natural gas and oil in the North Texas Barnett Shale. Watch -

N.Y.'s legendary Nathan's Famous is dramatically increasing revenues and profit by expanding nationwide sales of its famous hot dogs. Watch

-

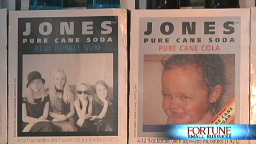

The ups and downs of Jones Soda, the alternative beverage company with a new CEO and a new business strategy. Watch

The ups and downs of Jones Soda, the alternative beverage company with a new CEO and a new business strategy. Watch

Top 3

| State | # of FSB 100 Companies |

|---|---|

| California | 18 |

| Texas | 12 |

| New York | 11 |

| Executive | Total Ownership Value ($ millions) |

|---|---|

| T. Kendall Hunt | 266.2 |

| Donald E. Brown, M.D. | 116.4 |

| George A. Lopez, M.D. | 103.5 |

| Company | Revenue growth (3-yr. annualized) |

|---|---|

| Arena Resources | 132.7% |

| Smith Micro Software | 97.8% |

| TGC Industries | 74.0% |

All companies that meet these criteria are ranked, 1-100, by their three-year annualized rates of revenue growth, EPS growth, and total return to investors... More