|

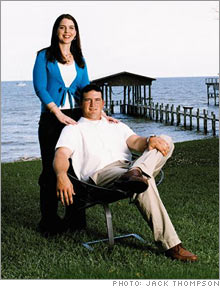

$30k in wedding debt...all paid off One year after a splurge, Doug and Tina Koch are free and clear. Here's how they did it.

(MONEY Magazine) -- "My husband Doug and I charged more than $30,000 to pay for our wedding, which MONEY featured in May 2005. But before we picked out a single centerpiece, we agreed to take on only as much debt as we could pay off by our first anniversary. To determine that amount, we tracked our spending: For a month we used only credit and debit cards, which gave us a paper trail for every dollar we spent.

If we needed cash, we wrote the purpose on the ATM receipt. If we cut out the non-necessities, we discovered, we could pay off $30,000 in a year. Once we started keeping track of our money, we were shocked at some of our habits. Eating out was costing us $1,200 a month. After the wedding, that couldn't continue so we went out only once every two weeks and packed lunches. We found cheaper ways to hang out with friends, such as grilling in our backyard. I cut out shopping, and Doug stopped buying pricey toys like ATVs. There were some unexpected expenses ($1,000 for Doug's back surgery, for example), but each month we mailed a check to our credit-card company. Eleven months later we'd paid off the entire balance. The experience got us thinking: What if we could save even half that amount each year for retirement? So we've now found other ways to save. We just downsized into Doug's previous home, which has no mortgage; I sold my SUV for a smaller car. But the nose-to-the-grindstone period is over. On our anniversary trip to Seattle, we walked into a mall - for the first time in a year. ___________________________ |

|