The market is always right. You're not.

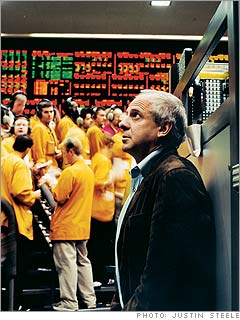

Yra Harris, principal, Praxis Trading

On Sept. 21, after news of the $8 billion hedge fund Amaranth's collapse broke, Yra Harris's phone rang incessantly. "Everyone wanted to know how much money I made," he says in his Chicago accent. Harris had been vigilantly watching the hedge fund's position for days, telling everyone within earshot it was going to explode. He knew that Amaranth's bets had artificially pushed natural gas prices up, but he never even made the trade: "It was just sport watching it."

That befits his low-key, professorial personality: He's the antithesis of the stereotypical cocky, swaggering trader. Harris, who primarily trades currencies, commodities, and futures, isn't as famous as, say, George Soros or Stanley Druckenmiller. But he's a trader's trader, cutting his teeth in the competitive pits of the Chicago Mercantile Exchange before moving upstairs to run his own shop. (He's in the process of jumping to a hedge fund.) Mention Yra (pronounced Ira) to most any pro who's worked the pits or survived years of market mayhem, and they're apt to utter "trading god."

Harris has ultra-strict trading rules. "The first thing I want to know in a trade is not how much I can make, but how much I can lose. So my No. 1 rule is using stop-losses." He pulls his money when a security reaches predetermined downside prices. "I may get stopped out three times losing small amounts of money in a very disciplined fashion. But if the fundamentals are right, I'll keep going at it until it turns around."

Second, he never trades more than three or four positions at one time. "If I'm running too many it gets muddled," he says, adding that he watches those positions like a hawk. "I dig hard to find out why money is moving into a country that's offering a 2 percent return on money while money is moving out of a country offering 10 percent."

Third, rather than making big bets, "I'd rather hit singles or doubles consistently. I do a lot of small trades. That keeps me focused and aware of trades going on around me."

Four: "Probably the most important lesson I've learned is that you can't get locked into a mindset," Harris says. "A lot of traders just keep adding to a bad position. I've seen guys give away huge fortunes. Bottom line: The market is always right--you're not." -- By Marcia Vickers

Global trader

Want to learn more Secrets of Greatness? Get the new book

|

|