NEW YORK (CNN/Money) -

Walt Disney Co. is nearing an agreement to sell the World Champion Anaheim Angels for less than estimates of the team's value, according to a source familiar with the negotiations.

The source told CNN/Money that the sale price for the team will be between $160 million and $180 million, and that it could be announced "in the next few days, maybe sooner." The deal would need the approval of other Major League Baseball owners.

Phoenix businessman Arturo Moreno, a former minority owner of the Arizona Diamondbacks, is seen as the leading bidder, but others, including real estate developer Frank McCourt and members of the Nederlander family, are possible bidders. The Nederlander family, which owns a chain of theaters, also has had a minority stake in the New York Yankees.

Moreno's net worth is estimated by Forbes magazine at $940 million. He made his fortune in billboard advertising, selling his company, Outdoor System, to Infinity Broadcasting in 1999 for $8.7 billion. Infinity later was bought by media conglomerate Viacom Inc.

The Angels' purchase price apparently will be greater than the $140 million Disney paid for the team in 1998, but the gain would not cover the cost of renovations Disney made on the team's stadium, estimated at $100 million.

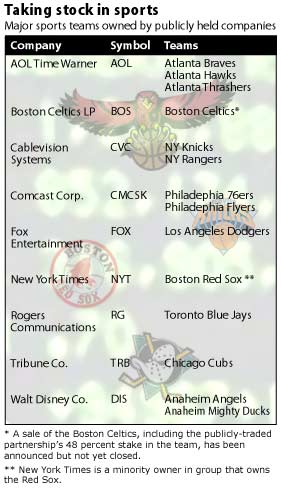

Forbes, which does the most extensive valuation of U.S. professional sports teams, last week estimated the Angels to be worth $225 million, up from $195 million the year before. But the market for teams is being depressed by a large number them now on the market, including the Los Angeles Dodgers baseball team, owned by News Corp., and the three Atlanta sports teams, the Braves baseball team, the Thrashers hockey team, and the National Basketball Association Hawks, which are owned by AOL Time Warner.

| Related stories

|

|

|

|

|

News Corp., which agreed last week to buy a controlling stake in Hughes Electronics from General Motors Corp., is in the process of weighing bids for the Dodgers submitted earlier this month. AOL executives have said it will consider bids for its teams and other "non-core assets" as it seeks to cut its $26 billion debt. CNN/Money is also a unit of AOL Time Warner.

In addition to the Dodgers and Braves, the Montreal Expos, which is owned by Major League Baseball's other 29 owners, also is for sale. Several other franchises, including the Minnesota Twins and Tampa Bay Devil Rays, are believed to be available for the right price as well. The number of teams on the market is depressing the value of all the teams, said a leading investment banker involved with team sales.

"This is the toughest market I've ever seen," he said last week. "There's no scarcity value to the franchises right now. In the past, when a team went for sale, it was like buying a Picasso -- you knew one would only be on the market once in a while. Now if you don't like the price, you can go down the road to another team."

Disney has never been able to find the synergies it hoped to from its ownership of the Angels along with its National Hockey League team, the Anaheim Mighty Ducks. Its plan to develop a regional sports network in Southern California under its ESPN brand that would have shown both teams' games never materialized.

The Angels have succeeded despite a relatively modest team payroll of $61.7 million last year, according to USA Today, which put it at about two-thirds of the Dodgers' payroll and about half of the league-leading New York Yankees. This year the team's payroll is up to $79.0 million.

But despite their on-field success last season, the Angels have always been seen as the second team in the Los Angeles market. It drew 2.3 million fans last year, compared with 3.1 million who came to see the Dodgers finish third. The Dodgers' broadcast rights deals brought it $27.3 million in 2001, according to figures released that year by Major League Baseball, compared with $10.9 million for the Angels' broadcast deals.

Click here for a look at media and entertainment stocks

Shares of Disney (DIS: Research, Estimates), a component of the Dow Jones industrial Average, gained 50 cents to $17.84.

|