NEW YORK (CNN/Money) -

There's been a lot of fuss this week about whether Google should really be worth $36 billion when it goes public.

Google generated more than $1.4 billion in sales last year, so at a market cap of $36 billion, it would be valued at about 25 times trailing revenues. Frothy? Sure.

But for a truly eye-popping IPO valuation, take a look at Nanosys, a nanotech firm that had just $3 million in sales last year.

If Nanosys, which is scheduled to go public next week, prices at the high end of its $15 to $17 a share range, it would debut with a market value of about $372 million. So it would be trading at nearly 125 times last year's sales!

Is a company that warns in its prospectus that it has yet to develop any products and may not do so for several years, if ever, really worth buying now? Nanosys simply says that it is developing technology for use in multiple industries, including energy, defense, electronics and life sciences.

If investors vote yes next week, then that could usher in a tsunami of companies with Nano in their names going public. The Nanosys offering is a pivotal one for the history of this young sector.

"This is a critical IPO. If it doesn't do well it will probably put a stop to a potential nanotech IPO trend," said Tom Taulli, founder of CurrentOfferings.com, an IPO research site.

Much ado about nano

Nanotechnology, the science of manipulating matter at the molecular level, has generated a lot of buzz during the past few years. But so far, most of it has been of the science fiction variety -- microscopic robots in the bloodstream fighting diseases, clothing that automatically changes styles, and flying cars.

Wall Street, however, has taken notice of nanotech. Late last year, many nanotech related stocks surged after President Bush signed a bill calling for $3.7 billion in funding for nanotech research over the next four years. (For more, read Big buzz...for tiny things)

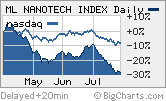

In April, Merrill Lynch created a nanotech index, consisting of stocks that the investment bank believes will have a significant portion of future profits coming from nanotech.

|

|

| Risky nanotech stocks have fared even worse than the broader tech sector lately. |

Most of the companies in the index are, fitting to the nature of their business, tiny. The largest, chemical maker Cabot, has a market value of $2.4 billion. None of the other stocks in the index have a market value above $1 billion. So that makes the index volatile.

And the timing of the launch wasn't exactly fortuitous -- tech stocks have been in a tailspin lately and speculative companies in particular have been pummeled. As such, Merrill's nanotech index has plunged nearly 27 percent since its inception.

So these stocks are not for the faint of heart. The Nanosys IPO is no exception either.

What the company does have in its favor is over 250 patents and partnerships with large corporations, including DuPont, Intel and Matsushita. But how do you put a value on this?

"There's nothing here in terms of an operational business. It's a laboratory," said Taulli.

Watch out for the hype

But if Nanosys does well, it will be increasingly difficult for investors to avoid all the breathless coverage in the financial press that will likely follow about the Nanosys wannabes. That's only natural.

| Recently in Tech Biz

|

|

|

|

|

Hopefully though, investors have learned from history. They don't have to look that far back either to find other examples of Wall Street fads at work. Biotechs were all the rage in early to mid 1980's and of course, the Internet was the superstar sector of the late 1990's.

"Like the Internet, nanotech may be overhyped short term," wrote Merrill Lynch analyst Steve Milunovich in a report that coincided with the launch of the brokerage's nanotech index.

He added, however, that high barriers to entry (think of all the research and development needed to come up with a successful product) should make for a healthy sector in the future.

Now sure, some nanotechs will probably wind up becoming this sector's equivalents of Genentech and Amgen or Yahoo! and eBay. This is a real business.

But identifying long-term winners in a sector still in its infancy is not easy, especially since nanotech has also attracted the interest of companies like Hewlett-Packard and IBM.

Merrill Lynch is one of the underwriters for the Nanosys IPO.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|