NEW YORK (CNN/Money) -

Chip stocks have taken a worse thrashing this year than Halle Berry has for her performance in "Catwoman".

Me-ow!

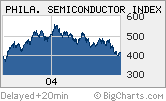

Despite a 3 percent pop in the past week, the Philadelphia Semiconductor Index, or SOX, is still down nearly 20 percent year-to-date and is trading 27 percent off its peak from earlier this year.

That is worse than a mere correction.

Semis have fallen on hard times, even though earnings growth has been solid, due to concerns that the chip cycle may already be close to peaking. Relatively sluggish economic figures from June and a sizable inventory increase at chip leader Intel (INTC: Research, Estimates) have fanned these fears.

"We are in a pause. People are still trying to figure out where we are in this cycle," said Patrick Ho, an analyst with Moors & Cabot.

But enough is enough.

The valuations of many chip stocks have finally come down to reasonable levels after last year's heady run in the sector.

Cheap chips

Intel is trading at about 18 times 2005 earnings estimates, only a slight premium to the overall market. The S&P 500 has a P/E of 16, based on 2005 estimates. And Intel is not alone.

|

|

| Semi slump: Chip stocks have given up nearly all of their gains from late last year. |

Semiconductor manufacturers Texas Instruments (TXN: Research, Estimates), Advanced Micro Devices (AMD: Research, Estimates) and STMicroelectronics (STM: Research, Estimates) and chip equipment firms KLA-Tencor (KLAC: Research, Estimates) and Novellus Systems (NVLS: Research, Estimates) all sport multiples of between 16 and 17 times 2005 estimates.

And chip equipment leader Applied Materials (AMAT: Research, Estimates) is trading at a discount to the overall market, at just 14 times 2004 earnings estimates.

Alex Vallecillo, a senior portfolio with National City Investment Management, which runs the Armada family of mutual funds, said that it's looking like the sector might be close to bottoming out.

"At some point you buy chip stocks with a hope that the worst case is dead money and we're getting close to that," he said. "A lot of semiconductor stocks are trading at mid-teen multiples, which are relatively cheap."

| �* data as of 8/2/04 | | �Source:��Thomson/Baseline |

|

Now chip bears would argue that the stocks deserve these current valuations because chip stocks will not be able to repeat this year's strong earnings performance. The average estimated earnings increase for the 18 stocks in the SOX this year is a staggering 186 percent.

But even though it's inevitable for earnings growth to slow, that's not the same thing as saying that the chip cycle is ready to go from boom to bust. "I don't think the cycle is over. It should be extended but muted," Vallecillo said.

Growth may slow but the cycle isn't over

To that end, the average growth rate for the 18 stocks in the SOX is 45 percent in 2005 and 18 percent over the next few years.

That's still quite healthy, especially when you compare it to expected earnings growth of just 8 percent next year and 7 percent annually over the next three to five years for the S&P 500.

| Recently in Tech Biz

|

|

|

|

|

Alan Loewenestein, co-manager of the John Hancock Technology fund, also said that he does not believe the current chip cycle is about to end. And he thinks promising earnings reports from Cisco Systems and Dell next week could be a catalyst to help get chip stocks heading higher again.

"We keep hearing from Dell about the PC sector doing well. And the Cisco call will be key. If they've worked out inventory issues, they'll have to re-order more chips," Loewenestein said.

With that in mind, he said that Intel, given its exposure to the desktop, notebook and server markets, and Cypress Semiconductor (CY: Research, Estimates), which counts Cisco as one of its top customers, are two of the fund's top semiconductor picks.

Cypress trades for just 9 times 2005 estimates. The fund also owns beaten down chip equipment firms Applied Materials and KLA-Tencor.

Vallecillo said his favorite chip stock holding right now is SanDisk (SNDK: Research, Estimates), which makes flash memory cards used primarily in digital cameras and MP3 players. The stock is trading at 14 times next year's profit projections.

He adds that he's also eyeing, but has yet to buy, Nvidia (NVDA: Research, Estimates), a graphics chip company that will report its latest quarterly results this week and trades at 15 times earnings estimates for next year.

But the key to whether or not chips are truly oversold, however, lies in what the companies tell investors about inventory levels in the third quarter and expected sales growth for the fourth quarter. That's especially true for Intel.

Intel's build up in the past two quarters has scared Wall Street because there are doubts about demand being strong enough in the second half of this year to justify the rise in inventory.

If Intel and other chip companies can reassure Wall Street that the back-to-school and holiday shopping seasons will be relatively strong, the inventory fears will wind up being for naught and the stocks should rally. But investors still seem to be worried about the worst-case scenario.

"Chip stocks are testing trough valuations but if we have a seasonal pickup the downside is somewhat limited," Ho said. "But if you don't get that seasonal pickup, then chip prices drop and inventory gets dumped in the channel. That's when havoc ensues."

Ho owns shares of Applied Materials but his firm does not have investment banking ties with it or any of the other companies mentioned.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|