NEW YORK (CNN/Money) -

It looks like nanotech isn't ready for prime time after all.

Nanosys, a nanotechnology company with no products that I wrote about last week, on Wednesday pulled the plug on its eagerly anticipated initial public offering.

I argued last week that investors needed to be wary of Nanosys (and the sector) since nanotech, the science of manipulating matter at the subatomic level, is still more about hype than real world business applications.

That it pulled the offering is a good sign. The company must have realized that investors have brushed up on their Who classics (or at very least, watched the opening credits of "CSI: Miami").

After all the dot-com IPO busts that followed the late 1990s tech runup, investors were not willing to get fooled again.

"Because Nanosys was planning to go public so close to what happened a few years ago, there was a negative connotation to the offering," said Kitu Bindra, co-chair of the nanotech industry group for intellectual property law firm Burns Doane Swecker & Mathis.

A successful offering from Nanosys could have led to a tsunami of nanotech IPOs in the near future. That's less likely to happen now.

Maybe next year

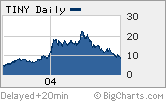

"In the short run, this confirms that we're now in a bear market. The IPO window for early stage companies is closing," said Charlie Harris, chairman and CEO of Harris and Harris Group (TINY: Research, Estimates), a publicly traded venture capital firm that specializes in nanotech and has a stake in Nanosys.

Shares of Harris & Harris fell more than 9 percent on the Nanosys IPO withdrawal news Wednesday and were down another 9 percent Thursday morning.

|

|

| Nanotech hype helped VC firm Harris & Harris Group but the stock has fallen on tough times lately. |

Matthew Nordan, vice president of research for Lux Research, a research firm focusing on nanotech, said that it would probably be at least nine months to a year before Nanosys is ready to again test the public markets. Lux Research is a spin-off of Lux Capital, a venture capital firm that has a stake in Nanosys.

In the interim, Nordan said that it's possible other nanotech companies will be brave enough to file for an IPO. But he quickly points out that only firms with actual products, not just patents, will have a chance of succeeding on Wall Street.

"It's like looking at a toddler and trying to figure out what he'll be like when he goes off to college. You really can't tell until he's 18," said Nordan about companies with no products. "There is demand for nanotech but other companies whose primary assets are intellectual property will not receive a warm reception."

| Recently in Tech Biz

|

|

|

|

|

Of course, this doesn't mean that nanotech is merely a fad that won't have a long-term impact on how we live. It would be silly to dismiss the importance of this young sector. There probably will be a bunch of high profile nanotech IPOs eventually. Just not this year.

"The next time you see the IPO market open for early stage companies you'll see many nanotech companies participating," said Harris. "It's just a question of when it happens, not if it happens," said Harris.

A bad omen for Google?

And Nanosys clearly had more going against it than just short-term skepticism about nanotech in general or criticism of its lack of products. In a filing with the Securities and Exchange Commission Wednesday, Nanosys said it was withdrawing the offering "due to the volatility of the public capital markets."

Translation? The stock market stinks right now. (Unless you're a short seller. Then you're probably pretty happy.)

The Nasdaq has plunged nearly 10 percent since the beginning of July. As such, Nanosys isn't the only prospective IPO to cut bait recently. Symmetry Medical and EMPI, both medical devices makers, postponed their IPO plans this week. (Neither officially withdrew them though, as Nanosys did.)

What's more, PlanetOut, which runs websites for the lesbian, gay, bisexual and transgendered communities (hence the proposed ticker symbol LGBT) lowered its offering terms to a range of $9 to $10 a share from $12 to $14 a share Wednesday.

And three other companies -- auto parts manufacturer Commercial Vehicle Group, drug developer New River Pharmaceuticals and customer service software firm RightNow Technologies -- slashed the offering prices of their IPOs Thursday.

With all this in mind, it could make next week's expected offering from Google an even tougher sell than it is already shaping up to be. Stay tuned.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|