NEW YORK (CNN/Money) -

Is the worst over for tech stocks?

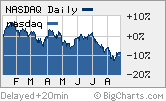

The Nasdaq has rallied about 5 percent since closing at 1752.49 on Aug. 12, its low point for the year. And there has been a spate of good news leading some to think the rally is justified.

First, bellwethers Dell and Applied Materials reported extremely strong quarterly results, suggesting that the excessive bearishness during the summer was overdone.

"Everyone and their mother had a negative opinion and groupthink tends to get the Street in trouble," said Ted Parrish, co-manager of the Henssler Equity fund. To take advantage of this, Parrish said he recently added to the fund's position in Applied Materials (AMAT: Research, Estimates) also purchased a new stake in Nokia (NOK: Research, Estimates), which has been particularly beaten up.

In another encouraging sign, Google gained 18 percent in its market debut last week, despite a veritable tidal wave of negative publicity leading up to its initial public offering. The stock has gained momentum since its IPO as well.

And from a macro-economic standpoint, a retreat in the price of oil has certainly helped ease some of investors' fears.

The glass is half-empty

Now here's the bad news.

This bounce has taken place during the market's dog days of summer, with light volume.

|

|

| Tech stocks have bounced back slightly after a rough couple of months. |

Todd Campbell, president of E.B. Capital Markets, an independent research firm catering to institutions, thinks that the upward move is due more to short sellers, who wager that stocks will decline, purchasing techs to cover their positions. And since volume has been low, what little buying there is has a big impact.

"The most oversold heavily shorted tech stocks are leading the group higher. To me, that's not a sign of a healthy rebound," said Campbell. "What I want to see are the strongest stocks showing big volume and rising. Few are doing that."

Some of the more dramatic gainers in the past few weeks have been companies with weaker fundamentals like Sun Microsystems (SUNW: Research, Estimates) and Nortel Networks (NT: Research, Estimates). Sun is up nearly 15 percent since Aug. 12 while Nortel has shot up more than 20 percent.

By way of comparison, Microsoft (MSFT: Research, Estimates) and Intel (INTC: Research, Estimates) are both up just 2 percent while IBM (IBM: Research, Estimates) has gained 3 percent.

| More about tech stocks

|

|

|

|

|

Valuations are still a concern. According to Thomson/Baseline, the S&P tech sector trades at more than 23 times 2004 earnings estimates, compared to a multiple of about 17 for the S&P 500.

And while techs are not as richly valued as they were earlier in the year, this still doesn't make the sector a screaming bargain. Investors still seem to have little faith that sales and earnings growth in the third and fourth quarters will be strong enough to justify a nearly 40 percent premium to the overall market.

"For tech multiples to significantly reverse direction, investors will need to feel comfortable about fundamentals again...including earnings estimates, IT spending trends, and macro issues," said Pip Coburn, global tech strategist for UBS in a recent report.

Sideways until November?

Intel could go a long way towards restoring some confidence in tech's growth prospects next week when it issues its mid-quarter third quarter update. Intel, the world's largest chip manufacturer, is the worst performing stock in the Dow this year.

Even though the company reported solid earnings last month, the stock has sold off on continued concerns about rising inventory levels as well as lower than expected gross profit margins, a possible sign of increasing price competition in the chip sector.

But then there's the question of whether or not anyone will be around to react to Intel's news. With the Republican National Convention taking place in New York next week, volume is likely to be even lower than is usually the case during the last week of August.

After the convention is over, the presidential campaign will really kick into high gear. And Parrish, who said he thinks downside for the sector is fairly limited over the next few months, concedes that tech stocks probably won't head significantly higher until investors have a better idea of who's going to win the election.

"The presidential race is still tight so market will be skittish," said Parrish. "Tech stocks will probably trade sideways."

|