NEW YORK (CNN/Money) -

PeopleSoft Inc., fighting off a $7.7 billion hostile takeover bid from rival software maker Oracle Corp., fired its CEO and president, Craig Conway, Friday, saying the board had lost faith in his leadership.

|

|

| The PeopleSoft board said it lost confidence in CEO Craig Conway's ability to lead the company. |

PeopleSoft said its founder and chairman, David Duffield, has taken over the CEO job. Duffield had served as CEO of the business software maker from August 1987 through September 1999.

"The board said its decision resulted from a loss of confidence in Mr. Conway's ability to continue to lead the company," PeopleSoft said in a statement. "All of these decisions received the unanimous vote of the independent directors."

During a conference call Friday morning, PeopleSoft director A. George "Skip" Battle added that Conway was not fired because of any "smoking gun", such as accounting problems with the company.

According to terms of his employment agreement from documents filed with the Securities and Exchange Commission, Conway is entitled to severance pay equal to two years of salary plus bonuses, as determined by the company's compensation committee.

Conway's salary is $1 million a year so he should receive at least $2 million as part of a severance package. He also has PeopleSoft stock options and restricted stock that will continue to vest.

Battle said during the call that Duffield would earn an annual salary of $1 and would not receive any equity-based compensation this year.

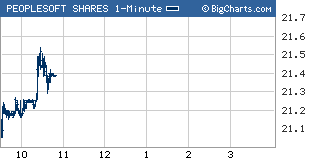

Shares of PeopleSoft and Oracle both jumped on the news, helping to light a fire under the broader market on the first day of the last quarter of the year.

PeopleSoft (PSFT: Research, Estimates) stock jumped about 8 percent on Nasdaq after the announcement, and traded slightly above $21, the price of Oracle's latest cash bid -- a sign that some investors expect Oracle to raise its bid, perhaps after cutting a deal with PeopleSoft's new management.

Shares of Oracle (ORCL: Research, Estimates) gained about 5 percent.

Despite the betting by investors, PeopleSoft's release seemed to suggest the company has not given up fighting Oracle's takeover bid.

"All decisions with respect to Oracle's tender offer have been made on the unanimous recommendation of the transaction committee of the board," Battle said in the statement.

Executives did not say anything beyond what in the statement about Oracle's bid during the conference call.

Oracle extended its bid, which it has raised twice and actually cut once, until Oct. 8.

Still, analysts said that the decision to fire Conway makes it increasingly likely that PeopleSoft will eventually sell out to Oracle. Conway, a former sales executive at Oracle, was said to be bitterly opposed to a deal with Oracle partly because of personal conflicts with Larry Ellison, Oracle's brash chairman.

Justice Department antitrust regulators had tried to block the Oracle bid for PeopleSoft, but in September a federal judge denied a request for an injunction against the deal, saying the government had failed to prove its case.

Conway had called that decision disappointing, and he blamed the ongoing takeover bid for hurting sales and making it difficult to persuade clients to close deals to buy its software, which helps firms manage and automate business processes.

The company also named Kevin Parker and Phil Wilmington as co-presidents and Aneel Bhusri as vice chairman. Parker also retains the title of chief financial officer.

Despite Conway's earlier statements, the company's statement Friday quoted Parker as saying sales of new software licenses were strong. The company said license revenues for the third quarter would be more than $150 million, much higher than what Wall Street analysts were expecting.

"We have had great success with both new and existing customers," Parker said. "Our performance demonstrates PeopleSoft's continuing competitive strength and ability to perform."

Wilmington will oversee PeopleSoft's operations in the Americas. Bhusri is general partner with Greylock Management Corp., a venture capital firm, and has been a member of the board since 1999.

During the call, Duffield said he was excited to be back in charge of the company he founded and that the management change was "in the best interest of shareholders." He added that he hoped to improve customer satisfaction and reinvigorate employee morale but did not expect any other major management changes at this time.

|